Is Dow 100,000 just down the road? One financial commentator thinks so. But, realize that extraordinarily bold forecasts usually occur at a particular juncture during a market’s trend. ~Tim McMahon, editor

Will the Dow Industrials hit 100,000 in the next decade?

By Elliott Wave International

Financial history shows that many investors are out of the stock market at major bottoms and “long” the stock market at major tops.

In other words, they miss important turns.

Why is this so?

It boils down to a single phrase: linear trend extrapolation. In other words, when stocks have been persistently rising, most investors believe they will continue to rise. Mind you, this is after many of these investors joined the bull market late in the game because they believed the prior bear market would also persist. When a new bear market starts, many investors believe the downturn is only temporary and they hold, which results in mounting losses.

As you know, the stock market’s trend has been up. And, evidence of linear trend extrapolation is easy to find.

Look at this Dec. 4 headline from The Globe and Mail:

Why the Dow at 100,000 may not be all that far away

The writer provided reasons as to why the Dow Industrials could hit such a lofty price level “well before 2030.” Of course, such a major price move in the Dow Industrials is possible, yet the point is: That’s linear trend extrapolation taken to an extreme.

In the past, such bold forecasts were made just as a trend was approaching an end. That doesn’t mean aggressive forecasts are a timing tool, it just means that caution may be in order.

Extremes in sentiment measures are also eyebrow-raising.

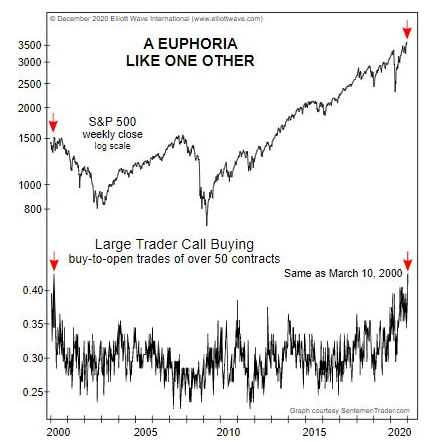

Here’s a chart and commentary from our just-published December Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets:

On November 27, Large Trader Call Buying, which tracks traders who purchase 50 contracts or more, spiked to 43% of total volume. As the chart shows, this reading matched the record set on March 10, 2000, which occurred 10 days before the S&P 500 peaked and the exact day of the NASDAQ’s top. Both stock indexes declined in a 2½-year bear market thereafter…

The December Elliott Wave Financial Forecast also provides Elliott wave analysis of the U.S. stock market — Elliott wave analysis will help you to stay ahead of the market’s next big turn.

You can read the entire December issue right now – FREE – inside EWI’s End-of-Year Market View “From 30,000 Feet” event.

They’ve broken the 10-page issue up into 5, easy-to-read sections. You’ll also get a quick video introduction for each section to help you put the text into context.

See what’s inside and prepare for the coming investment opportunities in 2021.

Read EWI’s December Financial Forecast now – free.

This article was syndicated by Elliott Wave International and was originally published under the headline Why Most Investors Miss Major Stock Market Turns. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind