Editor’s Note:

Editor’s Note:

Many people have been wondering what’s up with Gold. Why has it been performing so poorly over the last year? Well, In today’s article David Banister explains what has been happening in terms of Elliott waves and gives us a good explaination of where it will be heading over the next year or so.

GOLD close to Bottom of Wave 4– Preparing to Break-Out

Aug 8th 2012

By David Banister- www.markettrendforecast.com

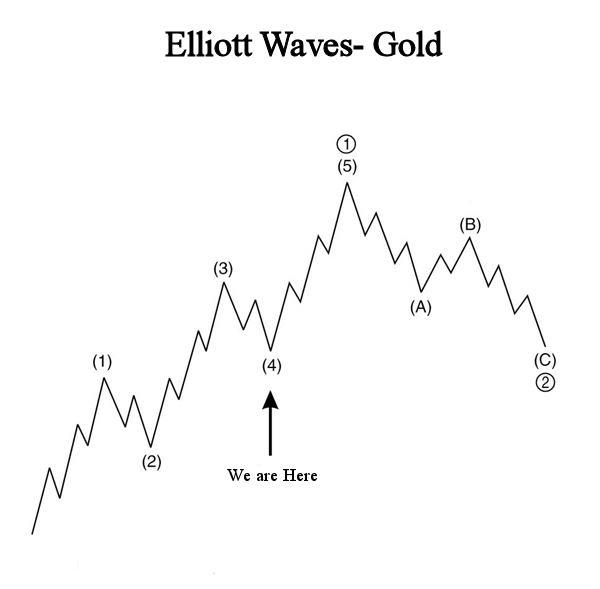

Back in the fall of 2011 I was warning my subscribers and the public via articles to prepare for a large correction in the price of GOLD. The metal had experienced a primary wave 3 rally from $681 per ounce in the fall of 2008 to the upper $1800’s at the time of my warnings in the fall of 2011. A 34 Fibonacci month rally was sure to be followed by an 8 to 13 month consolidation period, or what I would term a Primary wave 4 correction pattern.

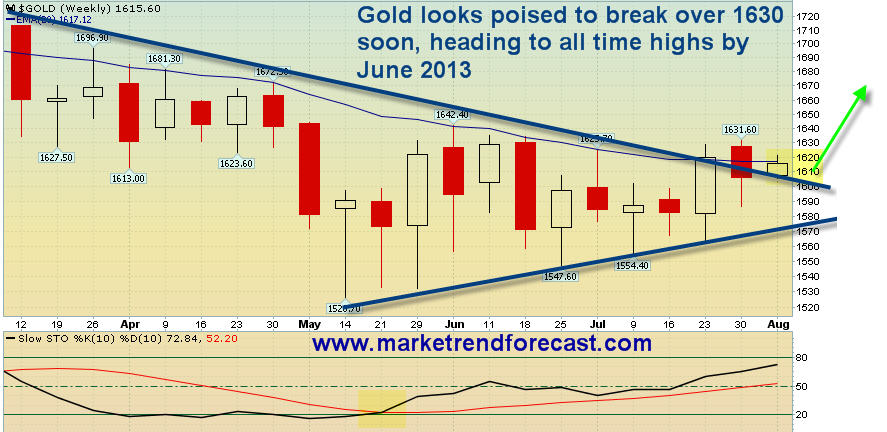

We have seen GOLD drop as low as the $1520’s during this expected 8 to 13 month window, but at this time it looks to me like a break over $1630 on a closing basis will put the nail in the wave 4 coffin. I expect GOLD to rally for about 8 to 13 months into at least June of 2013 and our longstanding target has been in the $2300 per ounce arena in US Dollar terms. Some pundits have much higher targets in the $3,500 per ounce or higher area but I am using my low end targets for reasonable accuracy.

This 5th wave up can be difficult to project because 5th waves in stock or metals markets can be what are called “Extension” waves. This means they can have a potentially much larger percentage movement relative to the prior waves 1 and 3 of the primary bull market since 2001. You can end up with a parabolic move at the end of wave 5, where those $3000 plus targets are possible. I expect the 5th wave to be about 61% of the amplitude of wave 3, which ran from 681 to 1923, or about $1242 per ounce. If we were to apply that math, we come up with $767 per ounce of rally off the wave 4 lows. $1520 plus $767 puts us at $2287 per ounce, or roughly $2300 an ounce low end target.

In summary, crowd behavior is crucial to the next coming movement in GOLD and it could be a sharp rally that catches many off guard, much like the downdraft last fall did the same to the Bulls. Be prepared to go long GOLD once over $1630 per ounce and buy dips along the way up to $2300 into the summer of 2013.

Receive our free weekly reports at www.markettrendforecast.com or sign up for a discounted subscription and get our reports daily on the SP 500 and GOLD.