Leonardo Fibonacci (aka. Leonardo of Pisa) was the son of a merchant working at a trading post in North Africa. At the time most of Europe was using Roman numerals which proved cumbersome when trying to add or subtract and keep the business’ books. Leonardo recognized that the Arabic numerals used in Africa were much […]

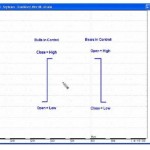

What A Simple Price Bar Can Tell You About A Market

Single- and Multi-Bar Price Analysis By Elliott Wave International Senior Analyst Jeffrey Kennedy has spent over 15 years developing techniques to “read between the lines” on a price chart, and he shares some of his techniques with you in a FREE eBook: Learn to Identify High Confidence Trading Opportunities Using Price Bars and Chart Patterns. […]

Trading Psychology: Don’t Trade With Your Ego

Elliott Wave Junctures editor Jeffrey Kennedy talks about “the elephant in the room” that no trader can ignore. By Elliott Wave International Senior Analyst Jeffrey Kennedy is a busy man. Along with his regular duties at Elliott Wave International, he prepares 3-5 video lessons each week that teach technical traders how to anticipate — and […]

Elliott Wave Trading Q&A

Tips on technical indicators and how to improve your trading. By Elliott Wave International There’s no shortage of actionable trading information out there, for every kind of trading style — countless newsletters, books, and websites to choose from. But how do you know when to apply this information to your trades? If you’re an experienced […]

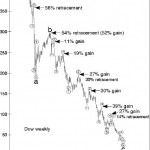

Characteristics of Zigzags Part 2

Basic Elliott Video Lesson — Characteristics of Zigzags For consistent trading, use Elliott as your metronome. By Elliott Wave International When you are new to trading with Elliott Waves, it can take some time before each pattern is easy to recognize and understand. But as with new music, the more you listen the more the […]

Basic Elliott Video Lesson — How the Zigzag Measures Up

Editor’s Note: This excellent video from Elliottwave International explains what the zigzag shape looks like in contrast to the other sideways structures such as a “Flat” and a “Triangle”. It also covers “Double Zigzags” and “Triple Zigzags”, plus the rules and guidelines for a Zigzag pattern. Tim McMahon~editor How To Differentiate a Zigzag From Other Elliott […]

Spotting Elliott WaveTrades- Charts and Video

By Elliott Wave International You can find low-risk, high-confidence trading opportunities by trading with the trend. The trick is to find the end of market corrections, so you can position yourself for the next move in the direction of the trend. On the left-hand side of the illustration below, there are two bullish trade setups. […]

The Investor’s Battle Between Hope and Fear

Editor’s Note: It has long been said that the key to successful investing is to be greedy when others are fearful and fearful when others are greedy. This is excellent advice if you have the fortitude to actually do it. If you succeed you will get out of the market when even the bag-boys at the supermarket […]

Become a Better Trader: Know Thyself

Editor’s Note: It may not seem like it at first glance but the stock market is one place where profitability is tied directly to your performance. If you do your analysis correctly and don’t get scared out at the first blip in the market you can develop winning strategies. But the converse is also true. Trading […]