The bearish case is beginning to make more and more sense. In my recent NASDAQ ROC stock commentary I warned that based on age alone the bull market is getting “long of tooth” and could generate a sell signal soon. And then we had Obama’s Comments Worry Stock Bulls showing how recent rhetoric by the President and FED chairman could be leading up to the next market sell-off. And today Chris Ciovacco will look at four more reasons why the best of the current bull market may be behind us. This does not mean we are recommending that you sell all your positions, merely that you start considering the possibility that caution is warranted. ~Tim McMahon, editor

Four Reasons To Respect The Bearish Case

by Chris Ciovacco

Stock market bears have accumulated four feathers in their caps, which tells us to remain flexible and open to additional weakness in stocks:

Four Feathers In The Bears’ Cap

- Economic Data Supports Tapering

- Slowing Momentum

- Market Breadth

- Stock Trends

Data Supports Tapering

One of the primary goals of the Fed’s money printing extravaganza is to move closer to their mandated “full employment” target. A big factor in Thursday’s market selloff was economic news that showed some progress on the employment front. From Reuters:

One of the primary goals of the Fed’s money printing extravaganza is to move closer to their mandated “full employment” target. A big factor in Thursday’s market selloff was economic news that showed some progress on the employment front. From Reuters:

The number of Americans filing new claims for jobless benefits fell to a near six-year low last week and consumer prices rose broadly in July, which could draw the Federal Reserve closer to trimming its massive bond-buying program.

Slowing Earnings and Technical Momentum

When fundamental and technical forces align, it usually makes sense to respect the synergy. If earnings ultimately drive the stock market, then the stock market bears have reason to hope. From the Columbus Dispatch:

Wal-Mart Stores, the nation’s largest retailer, missed analyst expectations in the second quarter and lowered its full-year profit and sales guidance yesterday, saying consumers were still weighed down. Wal-Mart attributed the sluggish results in the United States to the payroll-tax increases, a lack of expected inflation in food and “a general reluctance of customers to spend on discretionary items right now,” said Charles M. Holley Jr., Wal-Mart’s chief financial officer.

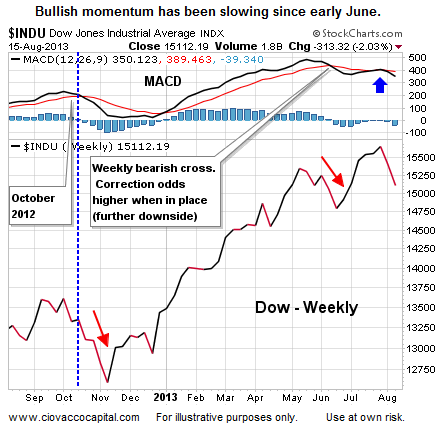

We noted on August 11 the Dow’s bullish momentum was slowing in a concerning manner. Wal-Mart’s outlook did nothing to improve the situation; the chart below is as of Thursday’s close.

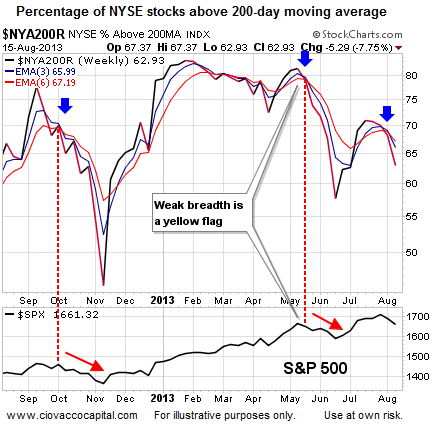

Bad Breadth- Lack of Participation

The previously noted slowing earnings momentum has been showing up on the market breadth radar. Market breadth speaks to the percentage of stocks participating in a rally. Healthy markets have broad participation. It would be disingenuous to refer to the market breadth chart below as “healthy”. The chart shows the percentage of NYSE stocks holding above their widely-watched 200-day moving average has been declining in recent weeks. This is a trend the stock market bulls would like to see reversed.

Market Trends Vulnerable

“The entrepreneur always searches for change, responds to it, and exploits it as an opportunity.” – Peter F. Drucker

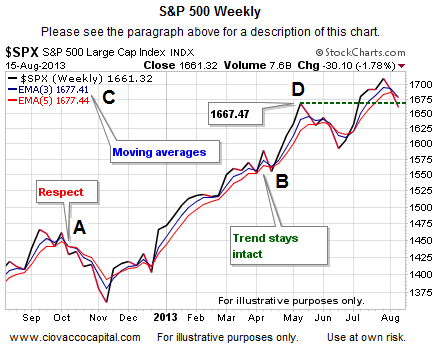

It is never a good idea to read too much into a weekly stock chart before week’s end, meaning Friday’s session offers an opportunity for some bullish repairs. However, given what we know Friday morning, the winds of change may be blowing in the bears’ favor.

The weekly chart of the S&P 500 below looks noisy and confusing at first blush. Therefore, we will explore points A-D in isolation to simplify things a bit:

Point A: Example of a “bearish and corrective” look, where price is below both moving averages and the blue line drops below red line. After point A, stocks corrected for several more weeks in late 2012. Point B: Example of a “volatility to ignore” look, where the blue moving average stays above the red moving average, and price never strays too far to the downside. Point C: As of Thursday’s close, the blue moving average closed slightly below the red moving average, which aligns with a “bearish and corrective” look. Point D: A weekly close below the May 2012 closing high of 1,667 would push the recent move higher into “false breakout” territory (not what bulls want).

Investment Implications – Flexibility Required

To become a better trader or investor, it is of uppermost importance to review all incoming information with as little bias as humanly possible. The tweet below from the carnage Thursday morning remains important over the coming days and weeks:

Our market model helps us discern between “volatility to ignore” and volatility that requires some defensive action. Until Thursday’s close, the recent bearish episode could be placed in the ignore category. Thursday’s weakness pushed the model into “some action required” territory. Therefore, we took an incremental step away from risk before Thursday’s close. If the market is weak again Friday, the odds are good we will take another incremental step to reduce our exposure to stocks.

If the bulls can counterpunch Friday, we are happy to hold our long positions in the S&P 500 (SPY), technology (QQQ), and small caps (IWM). We are in a good position to migrate to a more defensive stance or participate in any sustainable move to the upside. Based on extensive backtesting, our model relies heavily on weekly charts. Therefore, Friday’s session is important for both bulls and bears. This weekend’s video will chronicle what happened this week and what to watch next week. Stay tuned.

This entry was our opinion as of Friday, August 16th, 2013 at 8:34 am

You Might Also like:

[…] articles was developed separately by different authors from different points of view although Beware of Bears was written by the same author as one of the others. In today’s article John […]