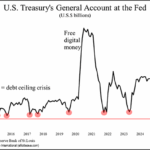

What’s another few trillion dollars? U.S. debt is already approaching a historic $37 trillion and now, Congress is discussing adding at least another $3 trillion to the “debt ceiling.” Yes, that’s the phrase that many hear on the news but know little about. Our June Global Rates & Money Flows sheds some historic light on the topic:Get ready for a summer of apprehension in America as the financial markets fixate on the level of U.S. Federal government debt and whether lawmakers allow the legal limit on it to be (once again) raised. What is the “debt ceiling” and does it really matter?

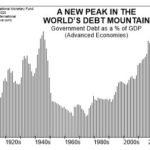

A Global “Debt Mountain”: Beware of This “New Peak”

Most people going about their daily business probably never give a moment’s thought to global debt. But, in EWI’s view, the topic deserves serious attention. You only have to think back to the 2007-2009 subprime mortgage meltdown to know why. Of course, subprime mortgages are a form of debt, and when many of these loans turned sour, the entire global financial system teetered on the brink of collapse. But, why were so many of these bad loans made in the first place? It boils down to one word: confidence … confidence that the loans would be repaid, confidence that the stock market would continue to rally, confidence in the economy, and confidence in the future, in general.

The Pros and Cons of Art Financing

The art financing market began in the 1970s. However, now the market is becoming increasingly sophisticated as financial institutions have created their own art financing divisions. Whether to turn to such funds to finance the purchase of new art needs to be carefully considered before getting a loan. Advantages of Borrowing Funds to Purchase Art The clearest advantage to a […]

Financial Planning Software

Financial Planning Software – Is It Beneficial for the Experienced Investor? Financial planning software is being used by many experienced investors to track their investments and set proper investment targets and accomplish their goals. It can be used to formulate a well-planned budget and carry out a thorough examination of your investment portfolio and get a clear idea […]

Quadrillion Dollar Debt: ‘Day of Reckoning’ Looms

A thousand trillion in debt can’t be wished away or swept under the rug. No one can “forgive” the debt. The consequences of unwinding this debt could be as massive as the dollar figure itself…