Investment advisors tell us… that as we get older we should take fewer risks with our investments and focus more on safety. This is because a young person has the opportunity for the market to “come back” after one of its periodic sell-offs. In addition, if you are still in the earning phase of your life […]

Fed Misstep Opens Weak Economy Door

Ben Had Just Reestablished Order After tapering comments spooked the markets in May, Ben Bernanke spent weeks trying to jawbone the markets back into a calmer state. He was successful for the most part with the S&P 500 gaining 132 points off the June low. Fed Tests Ideas In Print If you want to read […]

Market Jitters Concerning Pre-Labor Report

Prior to reviewing the state of the markets as of Thursday’s close, it is important to note if any economic report can “flip the charts”, it is the widely-anticipated monthly labor report, which is on tap for Friday morning.

Non-Traditional View of the Markets

Todd Harrison has vast trading experience as not only VP of worldwide derivatives at Morgan Stanley and Managing Director of Derivatives at the Galleon Group but also President of the Cramer Berkowitz hedge fund. He is also an Emmy award-winning producer with 21 years of experience on Wall Street. But now Harrison uses his expertise to educate […]

Online Trading On Your Own

Achieving large trading profits is now more attainable than ever for independent investors willing to invest the time and resources to succeed. The financial industry underwent a fundamental transformation during the information technology revolution in the mid-1990s that delivered the ability for individuals to eliminate the high costs associated with professional investment advisers in order […]

The 12 Rules to Follow for Buying Dividend Paying Stocks

by Dennis Miller Many of you have probably filled out one of the “retirement planner” forms available online. Plenty of tax and accounting programs also have “Lifetime Planner” sections for folks to determine if they can afford to retire. These sorts of programs plug certain assumptions into a formula, such as projected inflation rate, retirement […]

The Pros and Cons of Art Financing

The art financing market began in the 1970s. However, now the market is becoming increasingly sophisticated as financial institutions have created their own art financing divisions. Whether to turn to such funds to finance the purchase of new art needs to be carefully considered before getting a loan. Advantages of Borrowing Funds to Purchase Art The clearest advantage to a […]

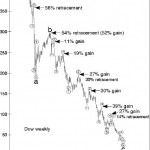

The Investor’s Battle Between Hope and Fear

Editor’s Note: It has long been said that the key to successful investing is to be greedy when others are fearful and fearful when others are greedy. This is excellent advice if you have the fortitude to actually do it. If you succeed you will get out of the market when even the bag-boys at the supermarket […]

Fixed Annuities vs. Permanent Life Insurance

Fixed Annuities vs. Permanent Life Insurance – Which is better? The short answer is that neither is better, both serve unique purposes in your overall investment scheme and both may be necessary. An annuity is an insurance product that pays out income and is usually used as a part of your retirement strategy. If you are looking for […]

Investing for Retirement

Investing for Retirement One of the biggest worries about retiring is the question of how to fund your living expenses for the duration of your retirement period. Most people do the basic thing which is to invest in a pension plan through their employer. If you don’t already have a workplace pension in place and are over a […]