It’s not easy to forecast the twists and turns in the S&P 500 — but this video shows how the EWAVES engine did exactly that.

Five Benefits of Using the Elliott Wave Principle to Make Decisions

While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. The Elliott Wave Principle is based on the concept that crowd behavior is patterned and that these patterns are easily discerned in the prices of freely traded markets. This alone sets it apart in the world of technical analysis.

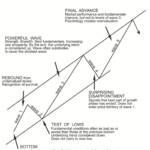

The Dow 8 Waves are Incomplete

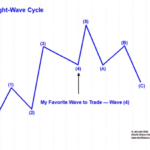

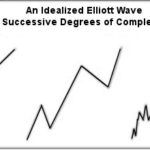

According to Elliott Wave Theory, each cycle is comprised of 8 waves. Each wave is comprised of smaller cycles. Cycles can take days, weeks, months, years, decades, or even centuries to complete. Now is the time to prepare for the completion of the biggest cycle.

The Journey to High-Confidence Trading Starts Now!

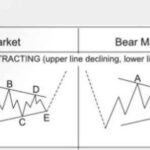

Next Stop: Corrective Elliott Wave Patterns

Soybeans and Apple stock (AAPL): Corrective patterns signaled opportunities in these disparate markets. Your market could be next!

By Elliott Wave International

The last 2 years have been a time of immense global adversity with the most challenging human health crisis in over a century.

But it has also been a time of immense personal growth. The uncomfortable realization of our dependence on others for everything from entertainment, education, nourishment, and income came into stark, swift focus. And with it, how quickly those things can be taken away without warning because of that dependence.

In turn, the pandemic saw an insatiable industry of online self-improvement crash courses emerge on home garden horticulture, podcast making, home building, home schooling, and — learning to trade financial markets to “ensure a steady livelihood despite economic setbacks.”

The problem is, learning to trade isn’t like learning to plant tubers in your backyard. It’s much more complicated and can’t be fully conveyed with mock “trials” or simulated positions. At best, many of such courses get people in the door, but not seated at the table of real-world practice and risk-management.

That’s where our respected partner Elliott Wave International (EWI) comes in. Its team of market analysts and technical analysis instructors has committed itself to leading the most comprehensive educational journey of the company’s 42-year long history.

EWI’s ultimate goal for 2022: Empower market newbies and veterans alike to develop and deepen their opportunity-spotting skills through the independent forecasting model known as Elliott wave analysis.

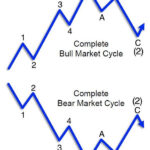

In brief, Elliott wave analysis, aka the Wave Principle, is founded on these core observations:

Market trends are driven by trends in collective investor psychology

Investor psychology progresses in 2 modes, impulsive and corrective

Correctly identifying these patterns at their onset illuminates future price action

One such mode of market progress is the correction, which is best defined by the “bible” of all things Elliott, Elliott Wave Principle — Key to Market Behavior:

“Markets move against the trend of one greater degree only with a seeming struggle. Resistance from the larger trend appears to prevent a correction from developing a full motive structure… Specific corrective patterns fall into three main categories: Zigzag, flat and triangle.”

This High-Confident Trade Set-up Makes for Highly-Confident Traders

“Confident trader.” Ten-fifteen years ago, the idea used to be an oxymoron — and now, it’s a multi-billion self-help industry with everyone from Wall Street gurus to armchair experts offering their brand of motivational wisdom:

Does the Stock Market Really “See” the Future?

the market follows the Wave Principle. It is not governed by the anticipation of future events, or for that matter, current events or anything external to the market.

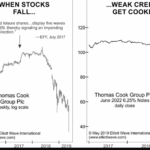

Spotting a 178-Year-Old Firm’s Collapse… 2 Years in Advance

On Sept. 22, Britain’s Thomas Cook, the world’s 2nd largest travel agency, collapsed. The 178-year-old firm blamed it on many factors: weather, terrorism, Brexit… But would you believe that Elliott waves foresaw the coming demise as early as 2017? In the following article, we’ll look at the unbelievable chart that predicts the collapse.

Summer of Love for Gold Bulls: How “Quandary” Became Clarity

As mainstream experts struggled to see the direction in gold, Elliott wave analysis saw a clear, bullish triangle. Then, gold prices rocketed to six-year highs!

Did You See the 30% Rise in This Major Global Stock Index?

In this video Robert Folsom shows the indicators leading the Hong Kong Hang Seng Index to gain 30% in 9 months.

What Does “Paddle-boarding” Have to do with Speculating?

Sometimes when your mind is in the “Zone” unusual correlations will just pop into your head. According to Wikipedia, “The eureka effect (also known as the aha! moment or eureka moment) refers to the common human experience of suddenly understanding a previously incomprehensible problem or concept.” An editor of Elliott Wave International had a eureka aha moment while paddle-boarding and in this article, he looks at Elliott Wave Setups, Cocoa and surprisingly how that correlates to of all things Paddle Boarding. ~ Tim McMahon, editor.