In today’s article, Chris Ciovacco looks at a few new signals, one has occurred 8 previous times, one occurred 5 previous times and one rare event that has only occurred three previous times in the last 90 years! He will also look at how stocks performed in all of those cases, looking out both months and several years.

Even though it is only July, in some ways May 2023 seems like a lifetime ago. Back in May the media and markets were in a panic because of the brewing “Banking Crisis” that began in March with the failure of Silicon Valley Bank. But at the time, Chris’ analysis was saying that the markets didn’t look “catastrophic” at all and instead looked quite optimistic. The following chart is one that he presented on May 26, 2023.

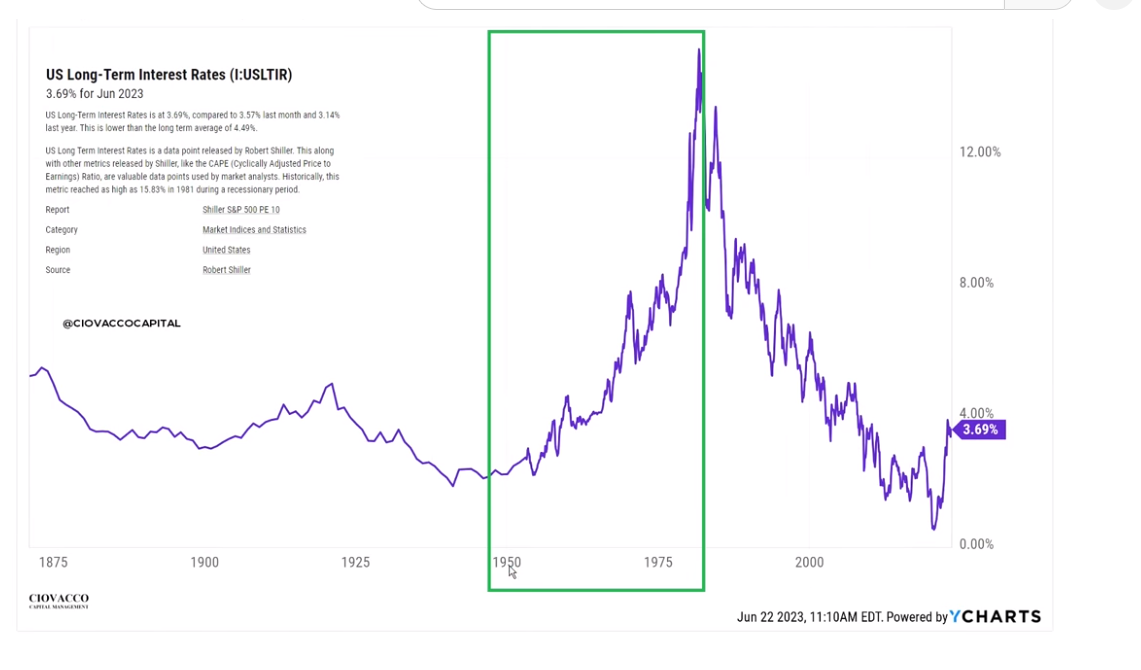

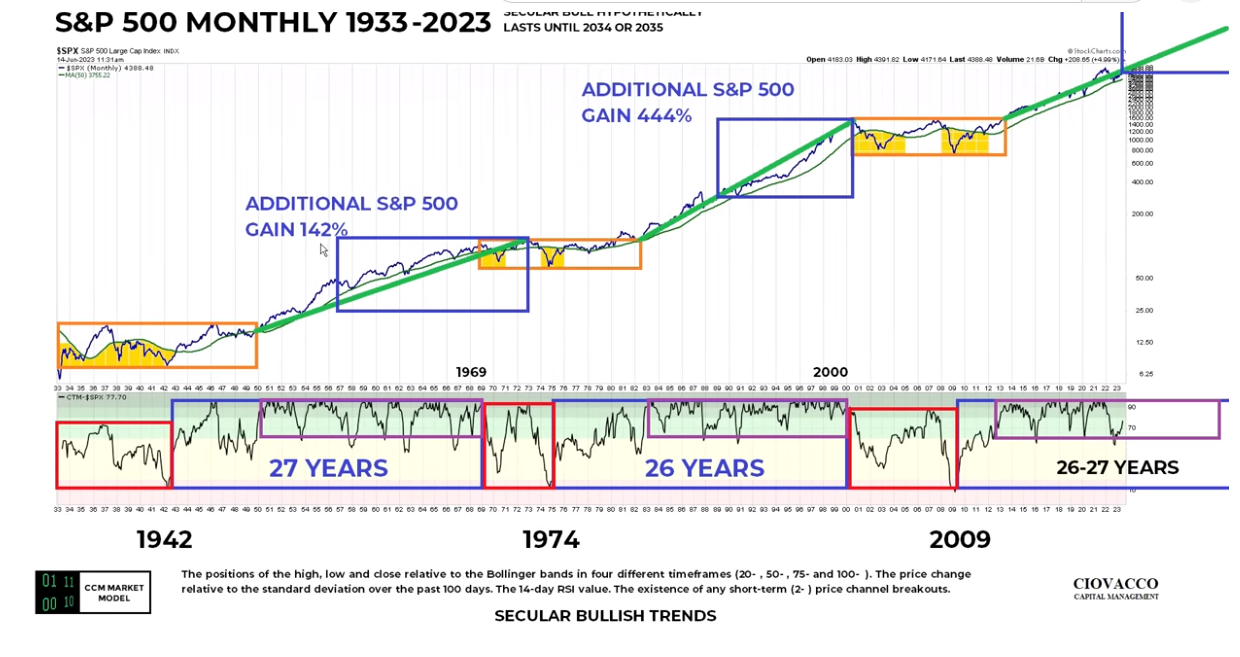

One of the major underlying factors of today’s market is rising interest rates which have spooked investors and the media. But as Chris points out, interest rates began to rise in the 1950s but the market didn’t tank but rather boomed for a long time.

In fact, during that rising interest rate period the S&P 500 actually gained 142%.

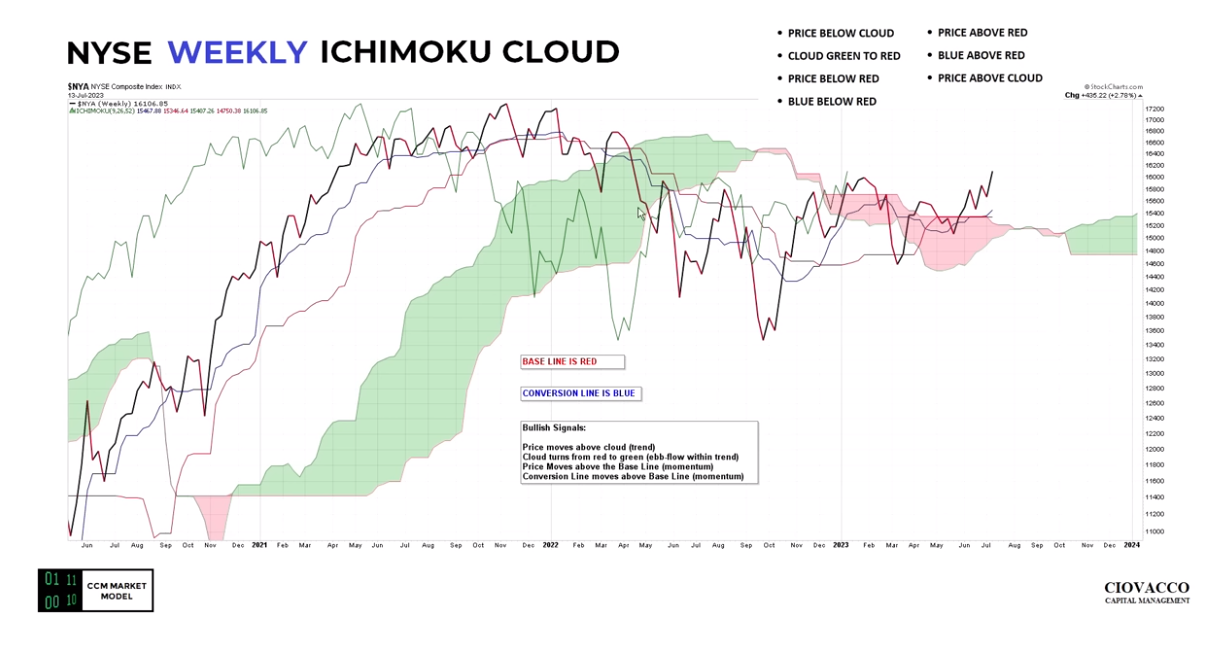

Chris goes on to talk about long-term opportunity, the amount of upside potential still in the market and how the current signals align with secular trends. He also explains how “Ichimoku cloud” analysis works.

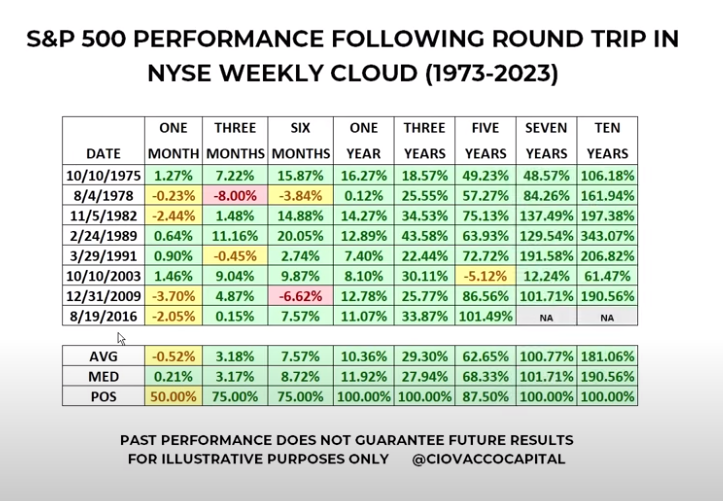

At this point, the Ichimoku cloud has turned from red to green looking positive. Since 1973 there have been eight cases in which the S&P 500 has made this type of reversal.

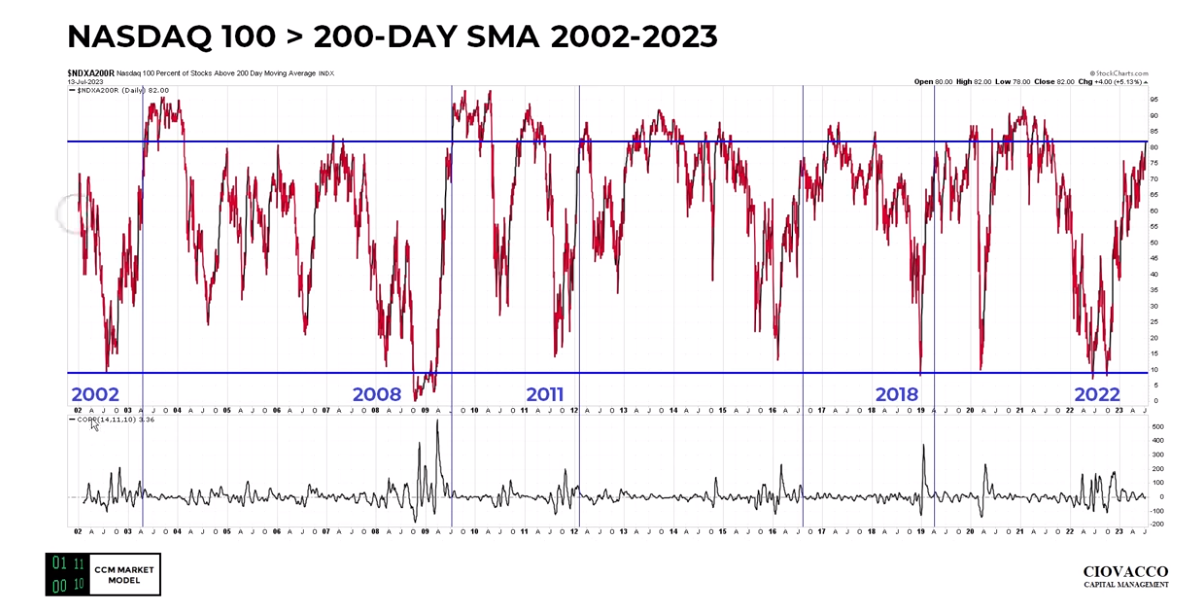

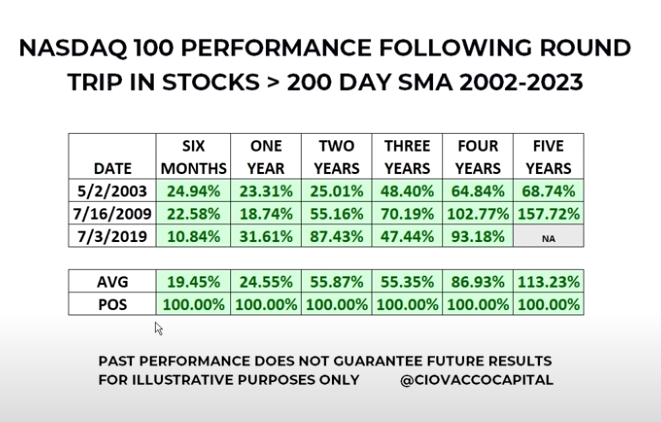

As we can see, the results have been overwhelming positive in everything except the very short term. Chris also looks at the “Coppock Curve” and its positive performance. In addition, he looks at the percentage of NASDAQ 100 stocks that are above their simple moving average. The chart has two blue lines, the lower line indicates that there are less than 10% of the stocks above their SMA. The upper line indicates that more than 80% of the stocks are above their SMA.

What happens when they shoot straight from the bottom blue line to the top blue line?

Note that the following performance is AFTER the index has already moved NOT from the low.

Looking at the S&P 1500 weekly with moving averages i.e. a broad index. When the short-term average (blue) crosses to the bottom, the mid-term average (red) is in the middle, and the long-term average (green) is on top the market is in a downtrend. Conversely, when blue is on top, red is in the middle and green is on the bottom, the market is in an uptrend. The Red Arrow indicates the point where the downtrend was confirmed in June 2022 and the green arrow indicates the change to an uptrend in July 2023.

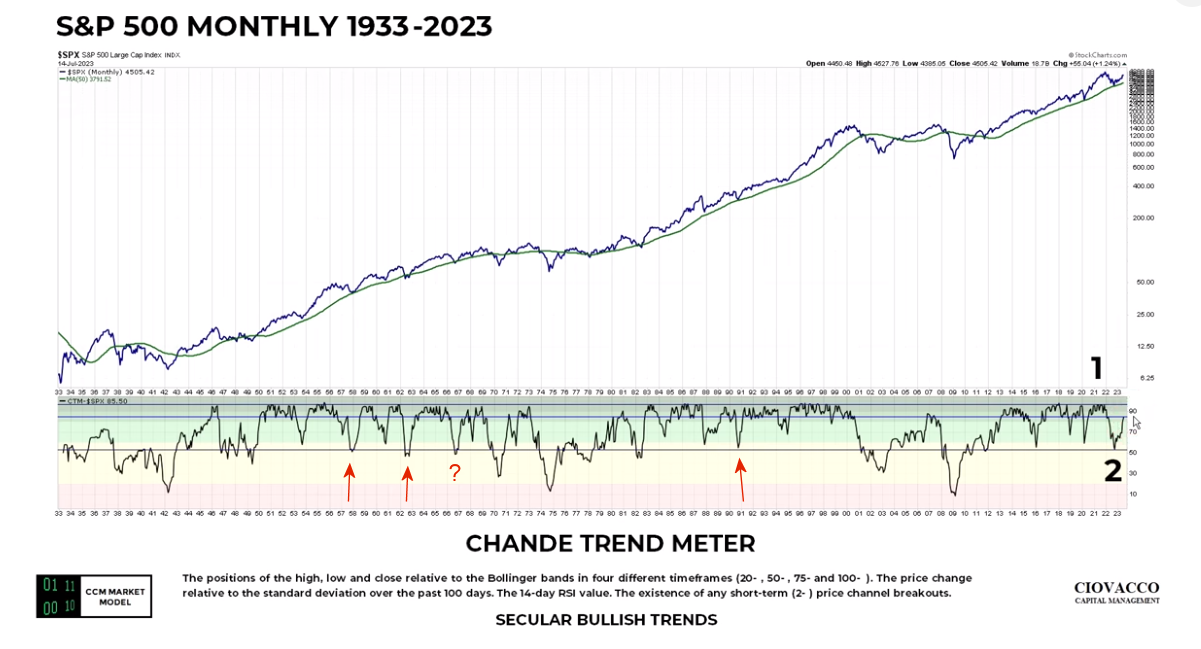

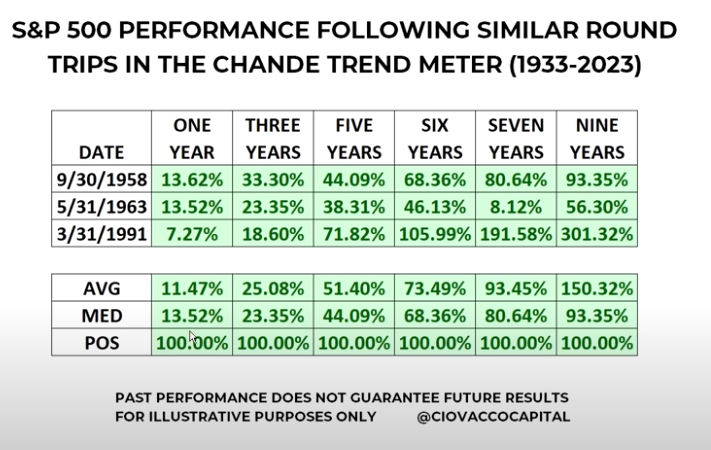

Rare Event Has Only Occurred 3 Previous Times in 90 Years

Since 1933 the Chande Trend Meter has only gone from bullish to bearish and straight back to moderately bullish three times. Chris lists them as 1958, 1963 and 1991. I might argue that 1967 also fits that profile although it wasn’t exactly a straight shot back to the top. But that event doesn’t change the results much, except in the longer-term categories.

So, all these instances are still checking the bullish boxes.

Chris originally posted this video on July 15,2023. You can view his full video here.

Speak Your Mind