Gold Has Now Entered Its Strongest Seasonal Period

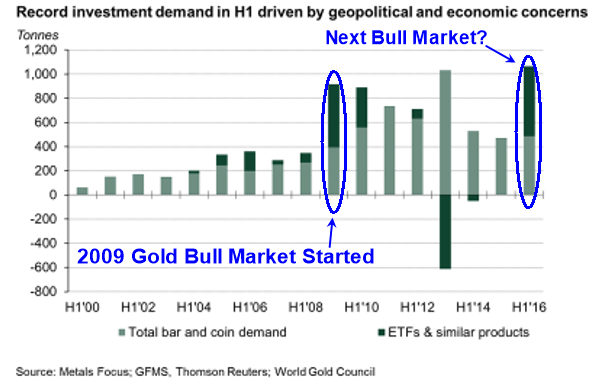

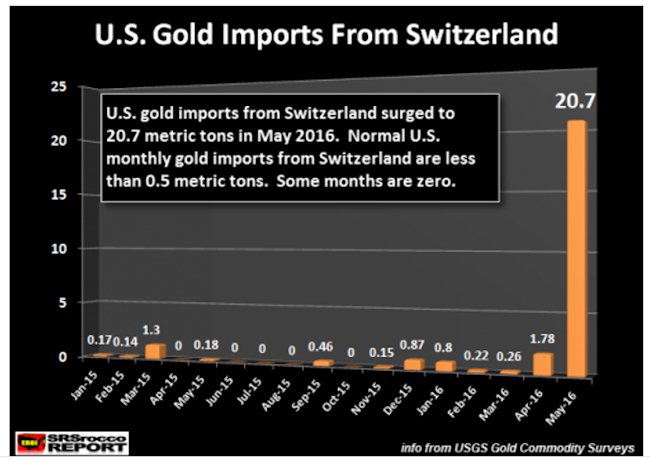

Investors should make use of golds’ lack of ‘correlation’ with other assets which makes it the best hedge against currency risk. Last May of 2016, there was a huge trend change in U.S. gold investment as the Swiss exported a record amount of gold to the United States. There has been a huge increase in

gold flows into the Global Gold ETFs & Funds. Something seriously changed, in May of 2016, as the Swiss exported more gold to the U.S. within one month than they have done so over the last year.

Gold has a “clear presence” to play in a world dominated

with ‘global economic uncertainty”

Despite the fact that we are in for a period of great financial turmoil, investors can safeguard themselves by investing wisely in gold. Do not be left behind and witness your dollar assets losing their value.

It is in these very conditions that gold (precious metals) is the only investment that will appreciate in value over time. Gold will continue to perform its’ role as a “safe haven” during these times of crisis which currently appear to be never ending. The metals surge of as much as 8.1% on the day of the “Brexit” vote, last month, is an indicator that its’ luster of safety is undimmed in the current markets. There is little to be gained from arguing whether such beliefs are right or wrong: Governments, around the globe, have moved to a new stage of desperation by toying with the idea of “helicopter money”.

It is my belief that since “Brexit” occurred, it could unleash a general exodus and the disintegration of the European Union is now almost unavoidable.

The list of prominent Hedge Fund Managers who are investing in gold is growing. Paul Singer, of Elliott Management Corporation, is the latest name to lend his support. It is likely that more investment institutions will turn to gold as the logical solution to countervail the effects of many years of ‘quantitative easing”.

Gold has been traded for over 5,000 years and for the first time has a positive carry in many parts of the globe as bankers are now experimenting with the absurd notion of negative interest rates. Some regard it as a precious metal while I regard it as a currency!

Soros Fund Management LLC, which manages $30 billion for Mr. Soros and his family, sold stocks and bought gold and shares of gold miners whilst anticipating weakness in various markets. Investors view gold as a ‘safe haven’, during times of turmoil but they tend to be late to the game as they don’t buy gold until there truly is turmoil and gold will have already appreciated substantially at that point.

“It’s a glaring warning sign of deflation. We’ve never really had deflationary fears throughout such a widespread part of the world before,” said Phil Camporeale, a Multi-Asset Specialist at JPMorgan Asset Management.

The FED is doing everything in its’ power to prevent a rise in the dollar. They are willing to “orchestrate” any scenario so as the stock market will continue to soar and people will feel a “wealth effect” from new stock market highs while the others are experiencing the economy “contracting”. The FED is getting everything it wants, in this regard, and will continue to do so as their number one priority is “debasing” the U.S. Dollar.

As the U.S. Dollar falls from all of the FEDs’ QE, it will lift up gold prices to unprecedented highs.

Investors of all levels of experience are attracted to gold as a solid, tangible and long-term “store of value” that historically has moved independently of other assets classes.

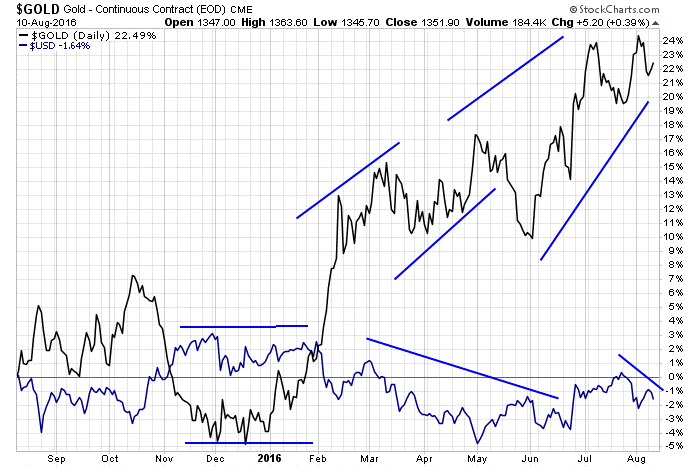

Golds’ importance, even in today’s environment, was clearly visible during the massive rally at the start of the year, when all other asset classes were tanking. Investors piled into gold on the scare of an imminent global financial reset.

Investors should make use of golds’ lack of ‘correlation’ with other assets which makes it the best hedge against currency risk.

Does Gold Continue Its Bull Market Towards $1500.00?

Conclusion:

The trend for ETFs to pile in to the precious metal sent the price of gold soaring by 25% in H1, the biggest price rise since 1980. For the first time ever, investment, rather than jewelry, was the largest component of gold demand for two consecutive quarters.

There will be another great opportunity in gold, silver and especially miners in the near future which followers of my work will benefit from. Follow my analysis and trades at: www.TheGoldAndOilGuy.com

Chris Vermeulen

This article originally appeared here and is reprinted by permission.

Speak Your Mind