According to Chris Vermeulen of Technical Traders the answer is a resounding YES! In the following article Chris tells us how the FED has ended its tightening phase which it pursued during all of 2018 and resulted in a huge market crash in the 4th quarter. ~Tim McMahon, editor

ADP Numbers and the US FED Hit the Launch Button

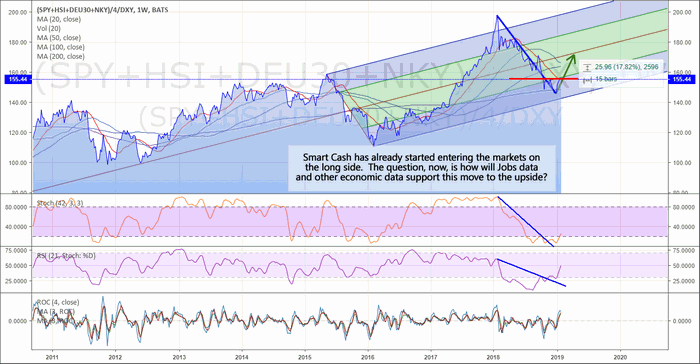

Get ready for a potential blastoff in the US stock market as all-stars are beginning to line up for an incredible upside price rally. The Fed, taking a warning from the markets and the global economy, has decided to leave rates unchanged for now. It appears they have moved to a more cautious stance in an attempt to foster continued economic growth over rate increases. The purpose of this is clear to anyone watching what is happening across the planet – the US is the strongest, most mature economy on the planet. The US fed can’t risk creating another debt/credit collapse at this time. It is better to move in measured steps than to move “all-in” over a short period of time.

Additionally, ADP released their Jobs numbers for December 2018 today with an expected 271k jobs number. This is an incredible number for December. Our interpretation of December employment numbers is that the Christmas hiring has already ended and many companies are have already shipped/supplied product for the holiday season. By December, we expect to see weaker jobs data with the expectation that firms are downsizing payroll while planning for the Spring sales season to get started. This does not take into consideration the weather events that typically plague December.

The only things left for this rally to really blast off would be strong earning data and some resolution to the China trade issues. If either of these “booster rockets” hit the news cycles over the next 30 days, we could easily see the US stock market rally toward all-time highs in a matter of weeks – not months.

Read the Full Article Here

Speak Your Mind