A recent low in the “CCC yield minus AAA yield” chart occurred very near a key Fibonacci level

By Elliott Wave International

The Golden Ratio — 1.618 or .618 — is ubiquitous throughout nature.

You’ll find this mathematical proportion in the shapes of galaxies, sea horses, pine cones, the arrangement of seeds on a sunflower head, and numerous other natural phenomena… including the chart patterns of financial markets.

Yes, chart patterns of financial markets are also parts of nature, because they’re created by the interactions of human beings.

Moreover, the Golden Ratio is highly useful in setting price targets and forecasting key junctures in those price charts.

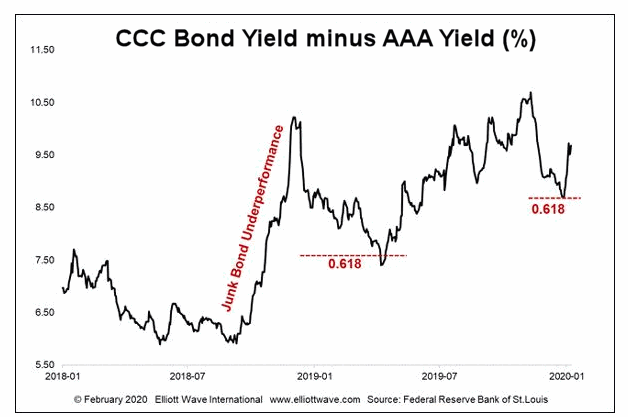

Indeed, Murray Gunn, Head of Global Research at Elliott Wave International, mentioned the Golden Ratio in his analysis of the junk bond market in our February Global Market Perspective. Here’s a chart and commentary:

The chart shows the yield of CCC-rated corporate bonds minus the yield of AAA-rated bonds, each denominated in U.S. dollars. Junk bonds (the CCCs) underperformed in the second half of 2018 and the subsequent retracement in the yield spread reversed around the [Fibonacci] 0.618 (inverse of 1.618) retracement in May 2019.

Another period of junk underperformance ensued into the beginning of December 2019 from where the spread contracted into last week’s low. That low, curiously, was within 4 basis points (0.04%) of the 0.618 retracement of the rally from May to December.

In our February Global Market Perspective Murray also indicates what he expects next for high-yield bonds.

And, while mentioning Murray, you may be interested in knowing that before joining EWI, Murray had worked as a fund manager in global bonds, currencies and stocks. He held long posts at Standard Life Investments and the Abu Dhabi Investment Authority. He then joined HSBC Bank as Head of Technical Analysis.

The bottom line is that Murray brings Global Market Perspective subscribers a wealth of valuable experience beyond his stellar Elliott wave analysis.

And, as you may know, Elliott Wave International President Robert Prechter co-authored a well-known book on Elliott wave analysis, which is titled Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

You can now access the digital version of this Wall Street classic 100% free.

You might also like:

Speak Your Mind