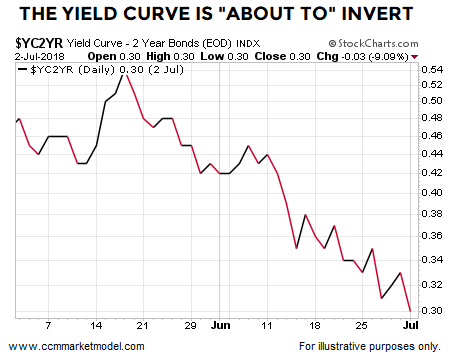

According to numerous articles written in the last six months, a flattening yield curve nearing the zero boundary is a major red flag for stocks and the economy.

Data this Week Looks Strong

Data this Week Looks Strong

Monday’s ISM Manufacturing data landed in a “strong and growing economy” range and nowhere near an “imminent recession” range. From MarketWatch:

The Institute for Supply Management said its manufacturing index rose to 60.2% last month from 58.7% in May. That matches the second highest level of the current economic expansion that began in mid-2009. In February the index hit a 14-year high. Readings over 50% indicate more companies are expanding instead of shrinking.

During the holiday-abbreviated session Tuesday, the latest read on factory orders was released. From MarketWatch:

U.S. factory orders rose 0.4% in May, led by an increase in demand for machinery and military wares. Economists polled by MarketWatch has forecast no change. The originally reported 0.8% decline in factory orders in April, meanwhile, was revised down to show a 0.4% drop, the government said Tuesday.

The Misunderstood Yield Curve

This week’s video takes a detailed and factual look at the yield curve, helping us address the following questions:

- Is it possible for really good things to happen after a period that features a flattening yield curve?

- If the yield curve continues to fall, should we sprint for the nearest exit?

- Is there any historical difference between “the yield curve is about to invert” and “the yield curve has already inverted”?

- In the 2000 and 2007 cases, how long did it take for the major stock market peak to arrive after the first sign of yield curve inversion?

- In the 2000 and 2007 cases, how much did the S&P 500 gain between the first sign of yield curve inversion and the major market peak?

You may also like:

- The Stock Market Big Picture

- Recent Breakouts Say a Lot about Markets and Economy

- Tariffs May Not Slow Profit Momentum

- Taking the Long View of the Market

This article by Chris Ciovacco of Ciovacco Capital Management originally appeared here and has been reprinted by permission.

Speak Your Mind