Today we have an in-depth Elliott Wave analysis of the Bitcoin Chart from Crypto Unplugged.

This excellent analysis looks at several ways to determine a potential top for Bitcoin and where we currently are in the cycle. The First analysis uses channels and Fibonacci Time Pivots.

Elliott Wave Analysis of Bitcoin

U.S. Dollar: Has the Mainstream Been Way Too Confident?

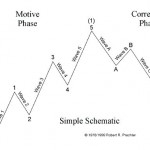

Investors who use Elliott wave analysis know that the main price trend of a financial market subdivides into five waves. Also know that wave 1 and wave 5 are often approximately equal in length. That knowledge helped the Global Market Perspective, a monthly Elliott Wave International publication that covers 50-plus financial markets, make a successful call on the U.S. Dollar index. The November issue showed a monthly chart which dates back more than 14 years

Does the Stock Market Really “See” the Future?

the market follows the Wave Principle. It is not governed by the anticipation of future events, or for that matter, current events or anything external to the market.

How to Build Consistent Trading Success

You’ve heard it all before:

If you want to trade using Elliott wave analysis, to succeed you first need to understand its rules and guidelines.

You need a clearly defined trading strategy (what? when? how? etc.) and the discipline to follow it.

Additionally, your long-term success depends on adequate capitalization, money management skills and emotional self-control.

Do you meet these qualifications, yet still struggle in the markets? If so, you may find some helpful advice in this quick trading lesson from Trader’s Classroom editor, Jeffrey Kennedy:

The 2 Most Important Keys to Successful Trading

Examples from Whole Foods Market and Reynolds American, Inc show you what to do (or not) to trade successfully with Elliott Wave By Elliott Wave International After 20 years of experience applying the Elliott Wave Principle, Senior Analyst Jeffrey Kennedy says that it remains the one tool that will tell him — down to the […]

Learn to Label Elliott Waves More Accurately

EWI Senior Analyst Jeffrey Kennedy shows you how to use momentum patterns to confirm your count Are you looking for an easy way to improve your confidence as you analyze the charts you trade? Take a quick look at this chart (adapted from Jeffrey Kennedy’s December 26 Elliott Wave Junctures lesson) to see how divergence […]

S&P 500: Did the 13.74-Point Rally Finish the Move?

Here’s what Elliott wave analysis is all about: You study charts to find non-overlapping 5-wave moves (trend-defining) from overlapping 3-wave ones (corrective, countertrend). With that in mind, please take a look at this chart of the S&P 500. Immediately, you can see that the S&P 500 has been moving sideways in a choppy, overlapping manner. […]