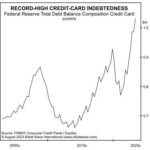

The following article by Elliott Wave International looks at the possible impact of the building debt crisis. We’ve all heard about the massive problem of College debt created by the easy-money policies of the government. But today we are looking at the impact of the massive credit card debt.

Be Prepared “Or Else”

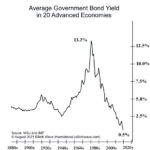

Ever since my Boy Scout days their “motto” of “Be Prepared” has been my guiding philosophy. Buying when things are plentiful is much better than fighting the crowds when things are scarce. (Think toilet paper in 2020). Unfortunately, “hoarding” has gotten a bad name because some individuals try to buy up all the scarce supplies WHEN THEY ARE SCARCE but if you buy when they are plentiful, it isn’t hoarding… it is being prepared. And rather than being a bad thing… it is actually a good thing. Here’s why: If you have your own supply you won’t be competing with the unprepared for the scarce resources. You may even have enough to share some with your friends and neighbors. In today’s article by Elliottwave International, we’re going to look at scarcity and its companion austerity and how they relate to the cost of money. ~ Tim McMahon, editor

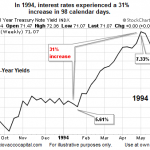

Will Raising Interest Rates Give Us a High Probability Short?

We know that rising interest rates are bad for bonds and gold and are considered good for stocks but in today’s article Chris Ciovacco looks at the effect rapidly rising interest rates can have on the stock market in the near future. ~Tim McMahon,editor 1994 Scenario: Market’s Worst Nightmare Spike in Rates Could Spook Stocks […]

Bernanke’s Burn Notice — Why Now? Research Reveals Insight Into Fed Chairman’s Popularity

Like a spy who gets a burn notice (as depicted in USA Network’s hit series, Burn Notice), suddenly he lost his support. No one trusts him anymore. Why the sudden turnaround in his fortunes?