Market breadth speaks to the number of stocks participating in an advance. Strong market breadth means a high percentage of stocks are making new highs as the major indexes make new highs. Strong breadth also aligns with widespread confidence in stocks and the economy.

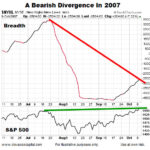

This indicator had a divergence in both 2000 and 2007; a divergence is also present in 2017

Stock Market Breadth: Is It Really That Bad?

Market breadth speaks to the percentage of stocks participating in a stock market rally. All things being equal, the broader the participation the healthier the market. In this article, we will examine breadth for both the S&P 500 and NYSE Composite Stock Index. We will also examine 2015 breadth vs. similar points after a correction and similar points in a bear market. Stock market breadth is not particularly useful as a short-term timing tool for the S&P 500; it can be helpful on longer-term time horizons.

Market Jitters Concerning Pre-Labor Report

Prior to reviewing the state of the markets as of Thursday’s close, it is important to note if any economic report can “flip the charts”, it is the widely-anticipated monthly labor report, which is on tap for Friday morning.