In good times for the market “growth” stocks, the NASDAQ and higher risk assets outperform “safe” stocks like the S&P 500. This is commonly referred to as “Risk-On”. But as the market becomes more cautious and participants are more concerned about the return OF their assets vs. the return ON their assets, they shift away from risky assets and towards Bonds, Utilities, and Gold.

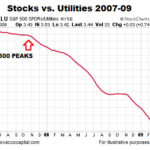

In the series of charts below Chris Ciovacco of Ciovacco Capital Management looks at how defensive assets are faring in the current market compared to how it performed in 2007-2009.