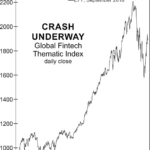

You may not have thought about it but short selling is a key component of modern efficient markets. Typically when you buy and sell things you buy them first hold them for a certain time (whether it is short or long term) and then sell it, (hopefully for more than you paid for it). But what if you feel the item is currently waaay too expensive? In that case, you can “sell short” in this case you borrow the item from a broker, sell it and when the price goes down buy it and return it to the broker. (Of course you have to pay the broker for any missed dividends and a “fee” for loaning it to you). But if the stock falls enough you can make a nice profit. According to Investopedia, “Short selling strengthens the market by exposing which companies’ stock prices are too high. In their search for overvalued firms, short sellers can discover accounting inconsistencies or other questionable practices before the market at large does.” So in effect, short sellers are registering a “negative vote” saying that they believe this stock is overpriced. But when bull-market hope turns to bear-market fear, short selling is often vilified as the cause of market crashes (rather than the fact that the short sellers were just observant enough to recognize overpriced stocks when they see them). This shift may be underway in Europe now. Whenever new technology enters a market it causes disruptions and eventually the old tech suffers as it is displaced by the new. Right now “FinTech” or Financial Technology is causing disruptions in Europe and as you would expect, the traditional financial services companies don’t like it. But the public becomes enamored with the new tech and drives up the price (often to extremely unreasonable levels). Once “irrational exuberance” takes over and the price of the stocks gets carried away then the short sellers come in with their “the emperor isn’t wearing any clothes” and the price of the new tech crashes until it can build a firm base, show real profits and begin climbing again. ~Tim McMahon, editor.

Tools for Technical Analysis

Sponsored:

Transform Your Portfolio With This Simple Morning Trade!

Dave Aquino wants to show you how to take advantage of a trading opportunity happening nearly every morning at 9:30 EST. His free guide, "How To Master The Retirement Trade" will show you exactly why traders in the know want to keep this trade a secret.

Claim your copy now!Subscribe NOW!

Never wonder again about whether the new information is out yet. You will be the first to know about the Elliotwave articles, Current Inflation and Unemployment Data and Financial Trend Forecaster Articles.

Plus you will also get the following special report absolutely free: “15 Ways to Beat 95% of All Investors”.

Click Here to SubscribeThis Company is Revolutionizing Autoimmune Healthcare.

This pioneering therapy offers a unique investment opportunity in a rapidly expanding market. With a commitment to excellence and patient-centric care, they're not just changing treatment protocols; they're transforming lives.

See how You can be part of this visionary journey in medical innovation.Free Stock Analysis Report: See The True Value of Any Stock

Get a full report that tells you what a stock is really worth, how safe the stock is, and if the timing is right to buy the stock. Plus a definitive Buy, Sell, Hold recommendation.

Analyze Any Stock Free!Search

Articles by Category

Articles by Date

Disclaimer

Privacy & Terms of Use

Work by editor and author, Tim McMahon, has been featured in Bloomberg, CBS News, Wall Street Journal, Christian Science Monitor, Forbes, Washington Post, Drudge Report, The Atlantic, Business Insider, American Thinker, Lew Rockwell, Huffington Post, Rolling Stone, Oakland Press, Free Republic, Education World, Realty Trac, Reason, Coin News, and Council for Economic Education. Connect with Tim on Google+ Read More…

Copyright © 2024 · Capital Professional Services, LLC · Maintained by Intergalactic Web Designers · Admin