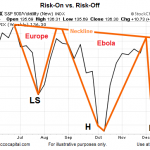

The market has seen a definite resistance line since it first tested 2000 back in July. It’s second attempt to break through came in September and the third attempt came in late November and early December and now it is trying to break out to the upside once more. Note that the second attempt was two months after the first and third was a little over two months but this test is only one month after the previous one with a very sharp rebound. In today’s post Chris Ciovacco will look at the possibilities.

Are Stocks About To Break Out Relative To Fear?- Video

The chart above has some common characteristics found in a potentially bullish formation known as an inverse head-and-shoulders pattern. A break of the orange neckline will improve the odds of the current rally in equities carrying quite a bit further.

Is This Lagging Sector Ready To Lead?

Investing is about probabilities. The improving fundamental and technicals in the housing sector tell us the odds of success in that sector are also improving. It should be noted that even if the weekly trends continue and homebuilders lead, that does not remove normal retracements and pullbacks from the equation. The odds of good things happening in homebuilders are better today than they were in early October.

Could The S&P 500 Fall To 1,625?

A Trip Down Correction Memory Lane Since the correction-less market theory has been dropping transmission parts over the last three weeks, it is prudent to revisit some topics we have touched on in the past. We will focus on two questions: How far can stocks drop? How long can corrections last? History Says Corrections Can […]

A Rational Look At Stock Market Risk

No Fear Mongering, Just Facts Group of 20 finance chiefs and central bankers said current risks include uneven growth and the possibility of excessive risk-taking in a low interest rate environment. They also pointed out that when push comes to shove, they will continue to stimulate. From Bloomberg: “It is critical that we take concrete […]

Anatomy Of A Stock Market Turn

Catch-22 Data Hits Tuesday Before we begin to examine the recent bottom in the stock market, investors were greeted with an eye-popping nugget of economic data Tuesday morning. From Reuters: The Commerce Department said on Tuesday durable goods orders, items ranging from toasters to aircraft that are meant to last three years or more, […]

Adjusting Your Investments

Regular readers know our approach involves meticulously paying attention to known information about the markets and making allocation adjustments when conditions change. Small caps provide a recent example of how this approach can be helpful to investors and traders.

How Should Investors Handle Iraq?

Less than three years after the abrupt U.S. pull-out of Iraq the country is falling apart as Islamic militants who seized cities and towns vowed to march on Baghdad and settle old scores. In northern Iraq, Kurdish security forces moved to fill the power vacuum — taking over an air base and other posts abandoned […]

It’s Difficult to Buy the Rumor

Rumor has it that the European Central Bank (ECB) fears low inflation or even deflation so what should we do with our investments? Should we, as the old saying goes, “buy the rumor, sell the news?” In today’s article Chris Ciovacco, looks at what is expected from Thursday’s ECB statement and what to do about […]

What Is Dow Theory Telling Us Now?

Positive Message For Manufacturing Stock prices have a high correlation to economic activity and earnings. History tells us bear markets are often kicked-off by recessions. The head of one of the nation’s closely watched manufacturing indexes says a recession does not appear to be imminent. From ThomasNet News: In a one-on-one interview with ThomasNet News […]