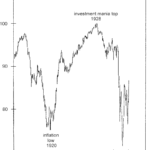

Financial advisors have long advocated a mix of 60% stocks / 40% bonds to cushion portfolios from downturns in the stock market. The thinking is that stocks go up in the long-term, hence, that’s where investors should allocate the most. At the same time, advisors acknowledge that stock prices can sometimes go down so “less risky” bonds will provide at least some protection. The problem with this investment strategy is that bonds can go into bear markets too. Moreover, they can do so at the same time as stocks. Let’s review what happened during the Great Depression of the early 1930s.

Warning: Mergers And Acquisitions Can Vaporize The Stock Market

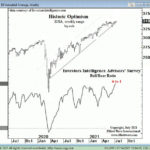

Historically we’ve seen that when market participants become overly optimistic the market has nowhere to go except down. This is logical because at optimism peaks everyone who has any money to invest, has already invested it, so there is no one left to buy. Conversely, when pessimism reaches extremes, no one is left to sell and so the market has to go up, as brave bargain-hunters re-enter the market.

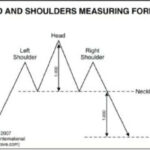

Euro: Look at This Head & Shoulders Chart Formation

You are probably familiar with the classic “head and shoulders” chart pattern. But, in case you need a refresher, here’s a brief description of a head and shoulders top: The high of an initial upward move is the left shoulder. After a decline, another upward move takes prices to a higher high, or the head. A second decline follows the head. A third rally then takes prices to a peak below the high of the head, and becomes the right shoulder. The left and right shoulders are often similar in duration and extent. A trendline connecting the two lows is called the neckline. When prices penetrate the neckline, a change of trend is believed to have occurred. Head and shoulders bottoms also occur and the same description applies except in reverse. This head and shoulders measuring formula — showing a top as an example — provides even more insight. The commentary is from a past issue of Elliott Wave International’s Trader’s Classroom:

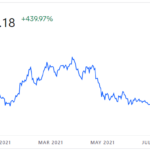

Will China’s Crackdown Send Bitcoin’s Price Tumbling?

Over the last year, bitcoin has increased by over 400%. As a matter of fact, it has more than doubled since the July low. In today’s article, we are going to look at whether news or even government actions affect the price of bitcoin. In the article, it refers to a proclamation made on July 2, where Elliottwave International says that the downtrend was ending… and then Bitcoin rose throughout July and August, fell through September (bottoming on September 28th), and then it began to rise again. ~Tim McMahon, editor.

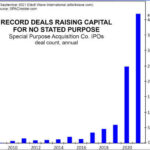

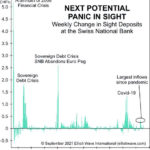

Why a Financial “Panic” May Be Just Around the Corner

Over the last few months, we’ve been warning that caution is the word of the day. The market was concerned that the FED’s September Statement would include provisions for tightening. That doesn’t seem to be their stance for the near future at least. But that doesn’t mean that the market is going to skyrocket either. As we can see in the following chart of the NYSE, the market definitely leveled off over the summer (despite the FED pumping $120 billion per month into the economy).

There’s one indicator that many investors overlook, and that’s the weekly change in “sight deposits” at the Swiss National Bank. This chart helps show when a financial panic could be building.

Will Oil Prices Skyrocket in the Aftermath of Hurricane Ida?

As you probably know, Hurricane Ida hit Louisiana on August 29, the exact date that Hurricane Katrina made a Louisiana landfall sixteen years earlier.

On August 30, the Wall Street Journal said:

Oil Industry Surveys Damage After Hurricane Ida Slams Louisiana

The storm disrupted fuel supplies, and the speed of the recovery will depend on how long it takes for refineries to come online amid flooding and power outages.

Did oil prices skyrocket due to the disruption in oil production? Well, Bloomberg reported (August 30) that prices initially fell 1.6% [as Ida made landfall] before they “edged” higher.

Be Prepared “Or Else”

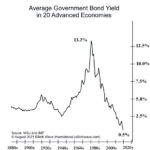

Ever since my Boy Scout days their “motto” of “Be Prepared” has been my guiding philosophy. Buying when things are plentiful is much better than fighting the crowds when things are scarce. (Think toilet paper in 2020). Unfortunately, “hoarding” has gotten a bad name because some individuals try to buy up all the scarce supplies WHEN THEY ARE SCARCE but if you buy when they are plentiful, it isn’t hoarding… it is being prepared. And rather than being a bad thing… it is actually a good thing. Here’s why: If you have your own supply you won’t be competing with the unprepared for the scarce resources. You may even have enough to share some with your friends and neighbors. In today’s article by Elliottwave International, we’re going to look at scarcity and its companion austerity and how they relate to the cost of money. ~ Tim McMahon, editor

Why the Stock Market is the True “Great Deceiver”

Most stock market investors get fooled at major price turns. Why? Because a bottom never feels like a bottom and a top never feels like a top – how many bears could you count in 2007, right before stocks tanked and the Great Recession followed? This idea was embodied by the quote attributed to Barron Rothschild, an 18th-century member of the Rothschild banking family. He said that “the time to buy is when there’s blood running in the streets.”

High “Beta” stocks … “Meme” stocks… and Index stocks… Oh My!

High “Beta” stocks tend to move in the same direction as the overall market but at a multiple of the overall index. So for instance, if the overall market is up 2% a high beta stock might be up 3% or 5%, or even 10%. “Meme” stocks are those that have gotten a lot of publicity on Social Media and also tend to be high beta stocks as well. Index stocks are those that make up a particular index and are often most volatile when first added or removed from an index. Today’s article covers the convergence of all of these three factors on June 25th.