High “Beta” stocks tend to move in the same direction as the overall market but at a multiple of the overall index. So for instance, if the overall market is up 2% a high beta stock might be up 3% or 5%, or even 10%. “Meme” stocks are those that have gotten a lot of publicity on Social Media and also tend to be high beta stocks as well. Index stocks are those that make up a particular index and are often most volatile when first added or removed from an index. Today’s article covers the convergence of all of these three factors on June 25th.

The Fear of Missing Out

The fear of missing out (FOMO) is a powerful narcotic that often affects market participants near the top of a cycle. And before long, you hear the “bag-boy” at the supermarket bragging about his “portfolio”. When that happens it is time to follow Warren Buffet’s sage advice and “Be fearful when everyone else is greedy and greedy when everyone else is fearful.”

Elliott Wave Analysis Can Help You See Countertrends. Pattern in Focus: the Zigzag.

Often, as traders and investors we start off with an open mind about playing the field, so to speak. We watch the news, listen to friends and colleagues — and we try to apply what’s known as “fundamental” market analysis to make our trading decisions. Soon, though, we start to realize that the “bullet-proof” logic of “fundamental” analysis is not Kevlar, but a piece of cardboard. We see markets fall after good news; rally after bad; and go sideways, defying both bulls and bears. That’s when we realize that trading is not as easy as it seems.

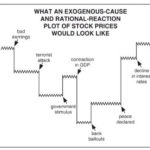

Capital Gains Tax Hike News: Was It REALLY to Blame for Sell-off?

As Elliott Wave International has noted many times, the mainstream financial press always tries to find a reason for a given trading day’s stock market action.

In other words, if stocks happen to be up for the day, many financial journalists will say it was because of this or that “positive” news. If stocks happen to be down for the day, you got it, these journalists will ignore the positive news and search for something “negative” that happened in the country or world and say that was the reason stocks went down.

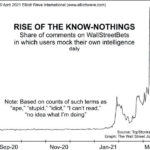

Rise of the “Know Nothings”

With the longest “Bull market” in history in full swing young investors are flocking to the market with no experience of ever having seen a full-fledged crash only “corrections” that are quickly reversed into higher and higher valuations. Twenty-somethings were still in elementary school in 2008 so it is a distant memory… let alone 2002-3 or 1989. With no experience in dealing with a crash, they are plunging into the market at record levels.

Are Investors “Courting Doom”?

Since the start of the pandemic, millions of people have opened trading accounts. Perhaps, you have as well. When stocks only go up – as they have over the past year – trading seems easy. That’s why many traders today use lots of margin debt. And why not? Borrowing to buy stocks can work out well during an uptrend. Yet, highly leveraged portfolios can be deeply wounded during a fast-moving downtrend. When this bull run ends, we’ll hear lots of stories about traders who got caught completely unprepared. Don’t let it happen to you.

Too Many Bulls?

We know from experience that whenever investor sentiment gets too lopsided — in other words, if there are “too many” bulls or “too many” bears — it inevitably means that a market reversal is near. Back in January, we ran an article on the extreme bullishness of the market and then we saw a correction but it didn’t last long enough and once again we are looking at a bullish etreme. Today we are bringing you an article from Elliott Wave International which looks at how bullish the current market is.

Should Stock Markets Fear Inflation or Deflation?

You can’t go ten minutes on financial media these days without coming across a reference to inflation. That is, consumer price inflation to be more exact — the measurement of changes in the prices of consumer goods and services that the entire world has been hoodwinked by central banks into thinking is the definition of inflation. The proper definition of inflation is the expansion of money and credit in an economy. On that definition, most major economies have been experiencing high inflation for decades.

Bitcoin: Let’s Put 2 Heart-Pounding Price Drops into Perspective

Bitcoin’s price fell hard, from above $58,000 to $45,000, and some are wondering if this is the start of a crash. Well, the word “crash” was also used back in January, when the cryptocurrency fell from $42,000 to below $30,000. However, prices bounced back. Let’s see how Elliott wave analysis can help put both price drops into perspective.