We know from experience that whenever investor sentiment gets too lopsided — in other words, if there are “too many” bulls or “too many” bears — it inevitably means that a market reversal is near. Back in January, we ran an article on the extreme bullishness of the market and then we saw a correction but it didn’t last long enough and once again we are looking at a bullish etreme. Today we are bringing you an article from Elliott Wave International which looks at how bullish the current market is.

Bullish Signal Has Only Happened 10 Times in the Last 94 Years.

In today’s article by Chris Ciovacco of Ciovacco Capital Management Chris looks at a Bullish Signal that has only happened 10 times in the last 90 Years. Plus 8 charts that show a bullish break upward through resistance.

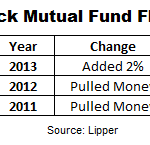

Have All the “Buyers” Already Bought?

In a Bull market that is appreciating sharply, greed begins to take over and people begin speculating with money they can’t afford to lose. Logic would dictate that when it gets extremely bullish everyone who is going to buy has already bought and so with no one left to buy the market falls. And when the market falls […]