With the current political upheaval in this country, it is difficult to see how the market can be so bullish. In today’s article by Elliott Wave International, we see that the market has “Great Expectations” for 2021. But as we saw in the previous article, Why Most Investors Miss Major Stock Market Turns, often when market-participants are most bullish is at the peak. And its not just amateurs that make this mistake, even “professionals” get caught up in the euphoria.

This makes sense in a strange sort of way. When everyone is “fully invested” there is no more money left to flow into the market so it has to go down. And when everyone has taken their money out of the market and put it in “safe cash” there is plenty of money available to drive the market up.

Recently Forbes published an article entitled 4 Stock Market Sentiment Indicators: Euphoric-Plus. The old market adage “when everyone else is buying you should be selling” might apply here.

~Tim McMahon, editor

P.S. At the end of this article, you can get free access to the online version (really free- no shipping) of the Elliott Wave Classic, Elliott Wave Principle: Key to Market Behavior

Cheers for the 2021 Stock Market and These “Great Expectations”

Insights into “the most speculative of strategies … among the most speculative of traders”

By Elliott Wave International

During this time of year, we’re reminded of the wonderful classic by Charles Dickens, “A Christmas Carol.” As you probably know, the Victorian-era British novelist also wrote several other books, including “Great Expectations.”

That title is also a fitting description of the mindset of many stock market investors as they raise their glass to 2021: “Cheers to the market!” One example of the positive expectations for the market is from a BMO Capital Markets’ strategist (Yahoo News, Dec. 7): “Expect another year of double-digit gains. We anticipate that 2021 has the potential to be one of the best years ever in terms of earnings growth.”

Yet another is from a Goldman Sachs’ strategist: “We recommend overweights in Information Technology, Health Care, Industrials and Materials.” Several other professionals have expressed “great expectations” for stocks in 2021.

But novice speculators are also on board.

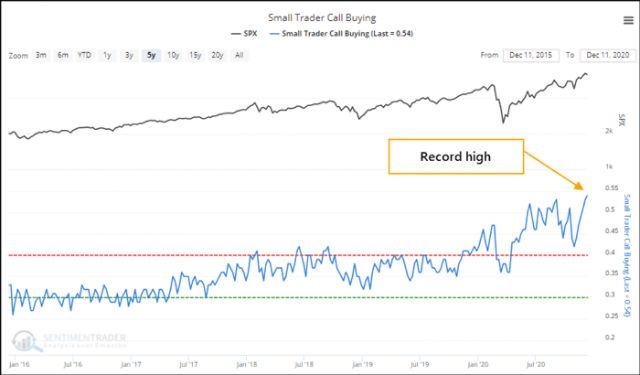

The December Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and social trends, showed this chart from SentimenTrader and said:

The chart shows that traders with only $9000 to their names are aggressive to a record degree.

The Theorist goes on to quote SentimenTrader:

“Among the smallest of traders, 54% of volume flowed into buying call options to open over the past week. That’s a record amount of focus among the most speculative of strategies and among the most speculative of traders. The 5-year chart shows just how much this behavior has ticked up.” — SentimenTrader

Should You Prepare Your Portfolio for ‘The Roaring 2020s’?

Well, according to the British financial magazine, MoneyWeek, the answer posed by the question in the title is a resounding “yes!”

The cover of the Dec. 4 issue of the magazine is titled “The Roaring 2020s, Prepare Your Portfolio for a Boom.”

An image of Janet Yellen is front and center. Of course, she’s the former Federal Reserve chair and the reported pick for Treasury Secretary in a new administration. She’s dressed in a 1920s party outfit and looks very festive.

Yet, stock market valuations are different when you compare the start of the 1920s with the 2020s in the U.S. Here’s a quote from the December Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets:

“As the bull market began in August 1921, the S&P 500 price-to-earnings ratio was 14. In September 1926, three years before the 1929 peak, the market’s p/e ratio was 10.72, even more subdued than in 1921. By the time that September 1929 arrived, the market’s p/e ratio had jumped to 20.17. At the February high this year, the S&P 500’s p/e ratio was 25.43. By December 1, it was an even higher 36.67. Other market valuation measures are just as extreme.”

Even so, the extreme optimism conveyed on the MoneyWeek cover is also reflected in a recent survey of market strategists. Here’s a quote from a Dec. 8 CNBC article:

“A majority of analysts surveyed by CNBC expect [an] 8%-22% upside for the S&P 500 in 2021.”

There are other signs of extreme bullish sentiment.

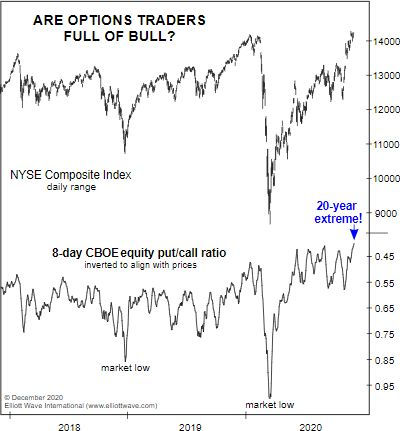

Here’s just one of them as we return to the December Elliott Wave Financial Forecast with this chart and commentary:

The option markets offer further evidence of intense speculation. The 8-day CBOE equity put/call ratio declined to .40 on Wednesday, the most extreme level of call buying to put buying in over 20 years. The last time the 8-day p/c ratio was lower was July 18, 2000, at the top of the initial rebound in the NASDAQ’s bear market from March 2000 to October 2002.

Great expectations, indeed!

Sentiment measures are just one way to take the market’s temperature. Another, more immediate way to look directly at the patterns of investor psychology is reflected in price charts via the Elliott wave model. Elliott wave analysis will help you ascertain whether stocks are near the start of a bull market (like the early 1920s) or much further down the road.

Here’s a quote from the “must-read” classic Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter:

“By knowing what Elliott rules will not allow, you can deduce that whatever remains is the proper perspective, no matter how improbable it may seem otherwise. By applying all the rules of extensions, alternation, overlapping, channeling, volume, and the rest, you have a much more formidable arsenal than you might imagine at first glance.”

Yet, we urge you to think independently about financial markets as we enter 2021. The Elliott Wave Principle can help you do just that.

Here’s another quote from Elliott Wave Principle:

“The practical goal of any analytical method is to identify market lows suitable for buying (or covering shorts) and market highs suitable for selling (or selling short). When developing a system of trading or investing, you should adopt certain patterns of thought that will help you remain both flexible and decisive, both defensive and aggressive, depending upon the demands of the situation.”

You can read the entire version of this investing classic online for free! All that’s required for access is a Club EWI membership (which you can get for free). Club EWI is the world’s largest Elliott wave educational community (approximately 350,000 members) and allows you free access to a wealth of resources on investing and trading from an Elliott wave perspective.

Join Club EWI for free Here and get started reading: Elliott Wave Principle: Key to Market Behavior

You might also like:

Speak Your Mind