In the following article Chris tells us how the FED has ended its tightening phase which it pursued during all of 2018 and resulted in a huge market crash in the 4th quarter.

Interest Rates Win Again as Fed Follows Market

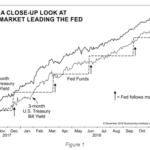

Most economists and financial analysts believe that central banks set interest rates. For more than two decades, Elliott Wave International has tracked the relationship between interest rates set by the marketplace and interest rates set by the U.S. Federal Reserve and found that it’s actually the other way around–the market leads, and the Fed follows.

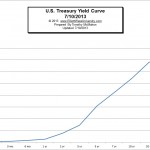

What is the Yield Curve and What Others Are Saying About It

What is the Yield Curve? The yield curve is a graphical representation of several “yields” or interest rates over varying contract lengths i.e. 1 month, 2 months, 3 months, 1 year, 2 years, 10 years, etc… The curve shows the relationship between the interest rate or cost of borrowing and the time to maturity. For example, interest rates paid on […]

FED Insiders Doubt Quantitative Easing Works

Behind Closed Doors at the Fed: Ten Years of Research into America’s Central Bank During the past few years, The Federal Reserve has engaged in a “deliberate inflating policy.” This policy earned disfavor, both at home and abroad. Robert Prechter said this in the July Elliott Wave Theorist: “Foreign powers have been irate over the […]

The Federal Reserve Does NOT Control the Market

As the world’s leading stock markets continue to play stomach-hockey with investors via one triple-digit turn after another, the mainstream community takes solace in this core belief: No matter how uncertain things become, the Federal Reserve can at any moment swoop in to set the economy right.

Understanding the Fed — Not Just the Myths About the Fed

If you would like to understand more about how the U.S. Federal Reserve works, you can spend time on its website — or you can get the real story. Elliott Wave International has collected eight of Robert Prechter’s most trenchant articles about what the Fed actually does. He takes on the misleading myths about the Fed and explains what’s really going on as he writes about these topics

You Still Believe The Fed Can Stop Deflation?

Think back to the fall of 2007. The deflationary “liquidity crunch” that over the next year-and-a-half cuts the DJIA in half, decimates commodities, real estate and world markets is only starting. Almost no one believes that the crash is coming — to a large degree, because everyone is convinced that the U.S. Federal Reserve Bank, with Ben Bernanke at the helm, will never allow deflation to happen: It can just print money! Well, take a look at these two charts EWI’s president Robert Prechter’s published in October 2007.

Same Day. Same Event. Same Market. Different Story!

Elliott wave analysts sometimes hear the criticism that patterns in market charts can be “open to interpretation.” Does that happen? Absolutely. (Although, there are tools an Elliottician can always employ to firm up the wave count.) But here’s the real question: What’s the alternative? Here’s Bob Prechter’s take on it.

Bernanke’s Burn Notice — Why Now? Research Reveals Insight Into Fed Chairman’s Popularity

Like a spy who gets a burn notice (as depicted in USA Network’s hit series, Burn Notice), suddenly he lost his support. No one trusts him anymore. Why the sudden turnaround in his fortunes?