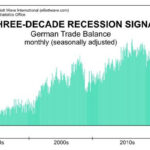

Many people are concerned about the return of a recession now that the FED has been actively tightening and the market has begun falling. Other indicators are flashing signs that we are already in a recession i.e. two consecutive quarters of falling GDP. But so far the National Bureau of Economic Research (NBER) hasn’t officially declared a recession to be in progress. Although, it generally takes them a while after the fact to make the official determination of the beginning (or end) of a recession. In addition to falling GDP other factors can trigger a recession as we will see from the following article from Elliott Wave International. ~ Tim McMahon, editor

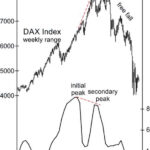

Germany’s DAX: What You Can Learn from the 2007 Top

This stock market indicator may be off many investors’ radar but a peak in consumer confidence tends to precede a peak in the stock market. With that in mind, back on Nov. 25, the Telegraph said: Consumer confidence has dropped sharply in Germany. … A few days later, the December Global Market Perspective, a monthly Elliott Wave International publication that offers coverage of 50-plus worldwide financial markets, provided a retrospective of Germany’s DAX and consumer confidence with this chart and commentary:

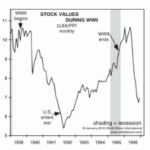

Is War Good for Stocks?

Many people believe that “War is good for Stocks” because the government pumps billions into the economy thus creating jobs and those new employees spend money having a multiplying effect on the economy. And when the economy booms the stock market booms right? In the following chart we can see that shortly after the U.S. entered WWII that the stock market began rising and it continued to rise throughout the remainder of the war. This is possibly why U.S. investors have come to believe that “War is Good for the Market”. But…