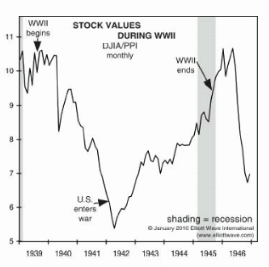

Many people believe that “War is good for Stocks” because the government pumps billions into the military complex, thus creating jobs, and those new employees spend money having a multiplying effect on the economy. And when the economy booms the stock market booms right? In the following chart we can see that shortly after the U.S. entered WWII that the stock market began rising and it continued to rise throughout the remainder of the war. This is possibly why U.S. investors have come to believe that “War is Good for the Market”. But before the U.S. entered the war the market had fallen drastically possibly because exports to countries already at war were falling and also because the fear factor caused investors to move to safer havens.

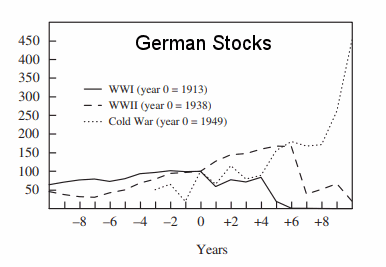

Certainly stocks of military contractors should boom during times when the government is spending big bucks on contracts. But does that apply to the overall stock market? In the following chart from Brookings Institute we can see how the German Stock Market performed before and during three major wars.

As we can see from the above chart the German Stock Market rose gradually prior to WW1 (solid line) and then fell throughout the war. The large dotted line shows that prior to WW2 it also rose and continued to rise until late in the war when factories were destroyed. During the “Cold War” when actual bombs were not falling the market rose much better than during any actual war.

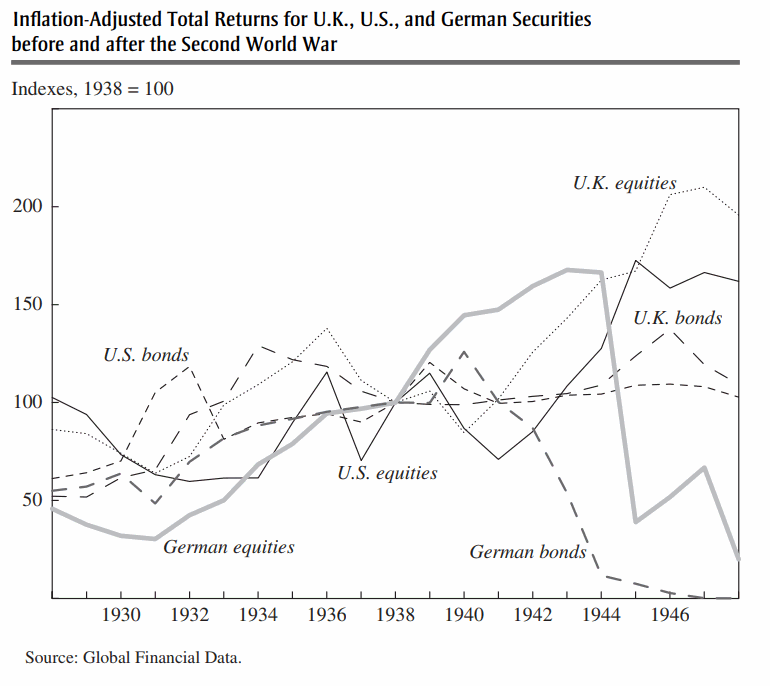

Another factor to consider is the destruction of productive assets that occurs during a war. In the above chart we can see that by the end of WW2 German bonds had fallen to zero and German Stocks were at less than 25% of their pre-war value. One factor that needs to be considered when looking at U.S. stock performance during wartime is that U.S. factories were not being destroyed during these wars because they were fought on foreign soil. In today’s article, Bob Stokes of Elliott Wave International looks at the question “Is War Good or Bad for Stocks?” ~ Tim McMahon, editor.

War! Good or Bad for Stocks?

Take a look at stock market behavior in times of war… and peace

By Bob Stokes

After the U.S. recently announced new sanctions against Iran, tensions have escalated between the two countries.

USA Today reported (May 7):

The Pentagon is rushing additional military muscle, including B-52 bombers, to the Middle East to counter Iranian threats to U.S. troops on the ground and at sea.

Of course, it’s always best when military conflict can be avoided because as U.S. President Abraham Lincoln said in an 1864 speech:

War at the best, is terrible …

How true. Yet, shifting to the financial arena, what can stock market investors expect during times of war? Is war also “terrible” for market participants?

Some market observers believe so and argue that war diverts resources from productive enterprise. Others posit that war is good for stocks and the economy because the government forks over big money to companies to produce war materials.

So, who has the winning argument?

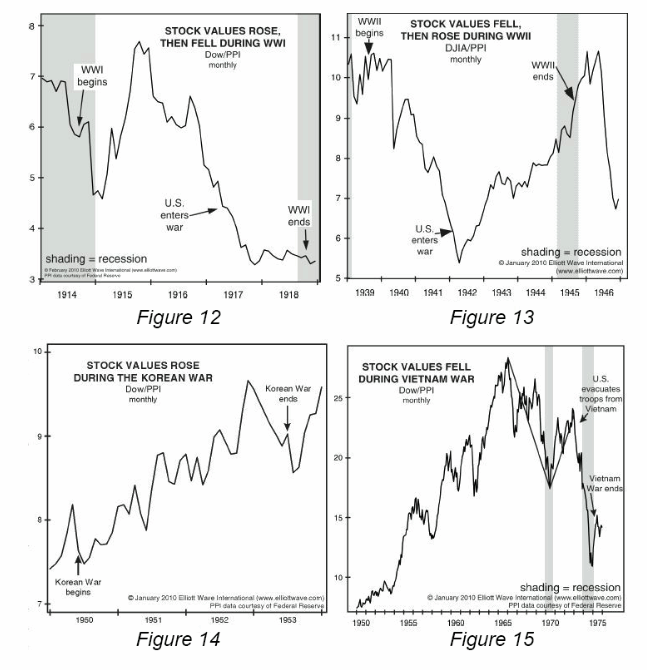

Well, among many countries in the world, the U.S. has been fortunate to have not had an international military conflict on its soil in the 20th century. If it did, the outcome for the U.S. economy and stock market may have been different. But as it stands, we looked at the path of U.S. stock prices during World War I, World War II, the Korean War and the Vietnam War to see if we could find any consistent correlations.

These four charts from Robert Prechter’s 2017 book The Socionomic Theory of Finance show you what our research revealed:

Figure 12 shows a time of war when stock prices (normalized for inflation) rose, then fell; Figure 13 shows a time when they fell, then rose; Figure 14 shows a time when they rose throughout; and Figure 15 shows a time when they fell throughout the hottest half (1965-1975) of a twenty-year conflict. Who wins the war doesn’t seem to matter. A group of allies won World War I as stock values reached fourteen-year lows; and nearly the same group of allies won World War II as stock values neared fourteen-year highs.

In other words, no consistent correlation was found between the performance of the stock market and war.

But, how about during times of peace?

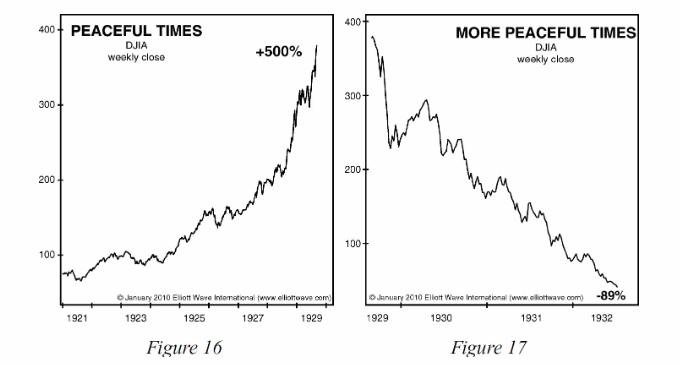

Here are two more charts from The Socionomic Theory of Finance:

Figure 16 provides an example from the 1920s in which stock prices seemingly benefited from peaceful times. The Dow rose over 500% in just eight years as peace mostly reigned around the globe.

Figure 17, however, shows that in the three years immediately thereafter, peace likewise mostly reigned around the globe yet stock prices fell more than they had risen in the preceding eight years!

So, despite assumptions to the contrary, the evidence shows that there’s no consistent relationship between U.S. stock prices and peace — or war.

For other widespread beliefs about the stock market that are simply not supported by the evidence, see our free report, “Market Myths Exposed”.

You might also like:

- The Long-Term Message from the VIX

- Is the Falling Trade Deficit Good for Stocks?

- Is Banning “Short-Selling” a Solution?

- Reversals And Counter-trend Moves Typically Take Time To Develop

Speak Your Mind