Prior to February 5th the market had gotten a bit complacent. It had one of the longest bull runs without a significant pullback in recent memory. All that bullishness led to low volatility and made investors lazy and less vigilant. But as we’ll see in the following article by Elliott Wave International market participants should have known better. The market can’t go straight up forever, it needs periods of consolidation to shake out the “weak hands” and build a more solid foundation as it climbs.

Was the 1,175 Point Drop in the DOW Unpredictable?

Tips for Trading Options with Elliott Waves

In this interview, Wayne Gorman, veteran Elliott wave analyst offers tips and strategies for trading options using Elliott Waves.

Trader – Made $41 Million Profit in 3 years Option Trading

Karen went from her day-job as an accountant to $41 Million in Profit In this video we look at how a former accountant named karen, went from having Merrill Lynch manage her retirement account and getting basically nowhere, to managing her own account and generating $41 million dollars in profit in only three years. And to […]

Trading Volatility

Volatility is the amount that a stock moves over a given period of time. At times markets experience periods of low volatility when the difference between the highs and the lows are relatively small. At other times, the market may experience high volatility with wild swings from low to high and back again. Generally, high […]

Control Risk With Options

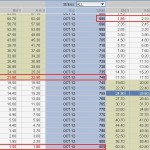

Using a Triple Calendar Spread to Trade Google Earnings October 16, 2012 By J.W. Jones One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading impending earnings announcements. Google will announce third quarter earnings after the market closes on Thursday. It does […]

Trade Considerations for Option Expiration Week

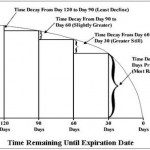

What do girls and options have in common? Options Expiration- “The girls all get prettier at closing time.” ~ Mickey Gilley ~ Option Expiration Week By J.W. Jones Option trading is not “just the same as stocks.” It turns on the three primal forces ruling an options trader’s world- time to expiration, price of the […]

“Time” – Key Factor for Options Traders

Editor’s Note: Options trading is almost as much about buying and selling time as it is about the underlying stock or commodity. In this article J.W. Jones explains the relationship between time and the price of an option and how to maximize your return based on the time value. Tim McMahon~editor The Passage of Time Leads […]

Binary Options Trading Software

Binary Options Trading Software There are a number of binary options trading software that can be used to increase the success rate of trades in this market. Just as is obtainable in the forex market, traders can use fundamental or technical analysis to predict possible trade outcomes. If you use technical analysis, you will no […]

Understanding Implied Volatility

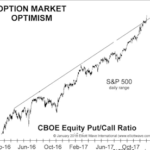

Option Prices and Implied Volatility Understanding implied volatility in option prices is a key factor in profitable options trading. According to Investopedia- Implied Volatility is: The estimated volatility of a security’s price. In general, implied volatility increases when the market is bearish and decreases when the market is bullish. This is due to the common belief […]