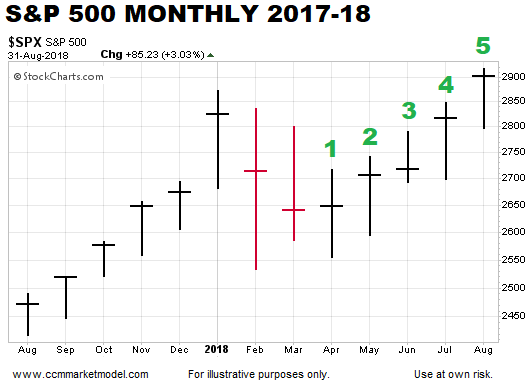

FIVE CONSECUTIVE GREEN MONTHS

When the stock market peaked in late January, many hypothesized it was the beginning of a long-term bear market. As shown in the S&P 500 monthly chart below, stocks posted red months in February and March, and went on to post gains for five consecutive months. The green months in April, May, June, July, and August mean the S&P 500 posted gains in 11 of the last 13 months.

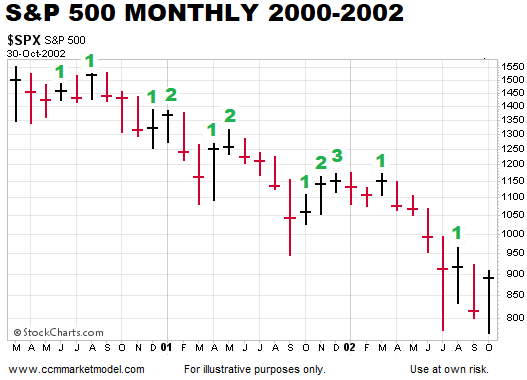

DOT-COM BUST BEAR MARKET

Did stocks ever post five consecutive months of gains in the 2000-2002 bear market? As shown in the chart below, the answer is no. A three-month rally in late 2001 was followed by significantly lower lows.

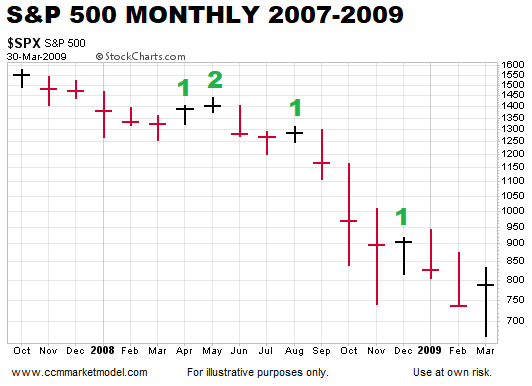

FINANCIAL CRISIS BEAR MARKET

The best the bulls could muster was two consecutive green months during the financial crisis bear market.

IS TREND EXHAUSTION A CONCERN?

Gains in 11 of the last 13 months align better with a strong uptrend rather than a major topping process. Thus, this week’s video takes a look at the status of the present-day bullish trend in the context of long-term trend exhaustion counts.

RELATIVE STRENGTH AND BEAR MARKETS

As noted in July, monthly RSI has also crossed bullish hurdles that acted as bearish barriers in the 2000-2002 and 2007-2009 bear markets.

This article by Chris Ciovacco originally appeared here under the title, “This Never Happened 2000/2008 Bear Markets” and has been reprinted by permission.

You might also like:

Other Article by Chris Ciovacco:

- Charts Say Stocks Could Rise For 10-15 Years

- Latest Economic Data Doesn’t Align with Yield Curve Fears

- The Stock Market Big Picture

- Using Longer Timeframes To Combat Volatility Fatigue

- Recent Breakouts Say a Lot about Markets and Economy

Speak Your Mind