These 3 charts help you understand how moving averages work Moving averages are a popular tool for technical traders because they can “smooth” price fluctuations in any chart. EWI Senior Analyst Jeffrey Kennedy gives a clear definition: “A moving average is simply the average value of data over a specified time period, and it is […]

Risk Management for Technical Traders [Interview Excerpt]

Tips from EWI Senior Analyst Jeffrey Kennedy’s Stocks and Commodities interview By Elliott Wave International If you trade with Elliott wave analysis, your trading decisions are all about the difference between where the market is vs. where it will be. According to Jeffrey Kennedy, editor of our Elliott Wave Junctures service, risk management skills are […]

Learn to Label Elliott Waves More Accurately

EWI Senior Analyst Jeffrey Kennedy shows you how to use momentum patterns to confirm your count Are you looking for an easy way to improve your confidence as you analyze the charts you trade? Take a quick look at this chart (adapted from Jeffrey Kennedy’s December 26 Elliott Wave Junctures lesson) to see how divergence […]

Don’t Trade Forex Looking in the Rearview Mirror

The foreign exchange (forex) market has a huge trading volume giving it high liquidity and making it the largest asset class in the world. Unlike individual exchanges like the London or New York stock exchange it is geographically diverse and operates continuously 24 hours a day (except on weekends). It also encompasses a variety of factors that affect exchange rates. It […]

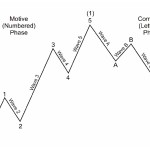

Reading the Wave Analysis Map

Which Works Best — GPS or Road Map? (Part 2) Trading with Elliott wave analysis By Elliott Wave International (Part 1 of this article is posted here.) A Quick Road Map of Wave Analysis For this overview of wave analysis, I have borrowed from the “Cliffs Notes” version that we provide for free to anyone […]

Fractal Geometry and the Stock Market

Which Works Best — GPS or Road Map? (Part 1) Trading with Elliott wave analysis By Elliott Wave International Some of the best stories about global positioning systems (GPS’s) are the weird detours they sometimes recommend to drivers. Just like some of the weird detours that financial markets can make you take when you think […]

Prechter: “This is Not a Picture of a Bull Market”

The three-and-a-half-year rally has occurred on declining volume By Elliott Wave International What a comeback for the Dow Industrials! From a March 9, 2009, close of 6,547, the senior index climbed to 13,610 on Oct. 5, 2012. Moreover, the Dow achieved this feat in the face of a weak-kneed economy, and it has grinded forward […]

(Video) Alcoa and Aluminum: Latest Price Action Suggests 2 Major Opportunities

Alcoa (NYSE:AA) and aluminum futures prices have “come into critical price areas.” By Elliott Wave International The editor of Elliott Wave International’s Metals Specialty Service, Mike Drakulich, has just recorded a new, free video forecast: “Aluminum and Alcoa: Exciting Juncture (Nov. 29, 2012.)” Says Mike (excerpt): “This is the first video of what is going […]

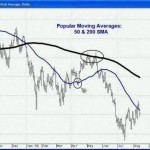

Moving Averages and the Elliott Wave Principle

Improve your Elliott wave pattern identification skills with this lesson By Jeffrey Kennedy / Elliott Wave International Moving averages are one of the most widely-used methods of technical analysis because they are simple to use, and they work. Among Elliott wave traders, you will likely find an especially high percentage of investors and traders who incorporate […]

An Elliott Wave Pattern that Signals the Start of Opportunity

The size of the wave will surprise most everyone On Monday Oct. 8 I sat down with Elliott Wave International’s senior analyst Jeffrey Kennedy to discuss his favorite wave pattern of all: the Elliott wave diagonal. Nico Isaac: You say if you had to pick just ONE of all 13 known Elliott wave structures to […]