Todd Harrison has vast trading experience as not only VP of worldwide derivatives at Morgan Stanley and Managing Director of Derivatives at the Galleon Group but also President of the Cramer Berkowitz hedge fund. He is also an Emmy award-winning producer with 21 years of experience on Wall Street. But now Harrison uses his expertise to educate […]

The Investor’s Battle Between Hope and Fear

Editor’s Note: It has long been said that the key to successful investing is to be greedy when others are fearful and fearful when others are greedy. This is excellent advice if you have the fortitude to actually do it. If you succeed you will get out of the market when even the bag-boys at the supermarket […]

Socionomics and the Misery Index

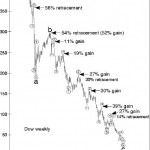

Socionomics is an area of study pioneered by Robert Prechter of Elliottwave International. It is the study of social mood and how it affects economics and politics. Traditional thought has it that good economic times cause euphoria and lead to investor optimism. Socionomic theory stands this on its head and says that investor sentiment is […]

Big Bear Markets: More Than Falling Stock Prices

Fear and uncertainty that drive a severe bear market are the same emotions which can set the stage for authoritarianism, in most any nation. Why do authoritarian tendencies emerge only during bear markets in stocks? Bob Prechter’s new science of socionomics gives you answers.

The Federal Reserve Does NOT Control the Market

As the world’s leading stock markets continue to play stomach-hockey with investors via one triple-digit turn after another, the mainstream community takes solace in this core belief: No matter how uncertain things become, the Federal Reserve can at any moment swoop in to set the economy right.

Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part III

In the November 2009 issue of Elliott Wave International’s monthly Elliott Wave Financial Forecast, co-editors Steven Hochberg and Peter Kendall published a careful study of Goldman Sachs company history — and made a sobering forecast for its future. In this special three-part series, we release that Special Report to you. Here is the final installment, Part III.

Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part II

In the November 2009 issue of Elliott Wave International’s monthly Elliott Wave Financial Forecast, co-editors Steven Hochberg and Peter Kendall published a careful study of Goldman Sachs history — and made a sobering forecast for its future. In this special three-part series, we are releasing the entire Special Report to you. Here is Part II; please come back later this week for Part III.

Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part 1

In November 2009, Elliott Wave International’s monthly Elliott Wave Financial Forecast published a careful study of Goldman Sachs’ history — and made a grim forecast for the firm’s future. In this special three-part series, we will release the entire Special Report to you. Here is Part I; come back Wednesday and Friday for Parts II and III.

What Does NOT Move Markets? Examining 8 Claims of Market Efficiency

Economists love to talk about exogenous shocks — events outside of the financial system that cause markets to move. But what if it’s just talk and not real at all?