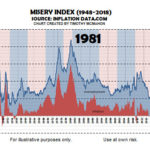

If someone told us in 1981 the S&P 500 would post a 1,367% gain over the next 18 years, it would have been very difficult to believe after seeing an all-time high in the misery index in June 1980. From miseryindex.us:

“The misery index is simply the unemployment rate added to the inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation both create economic and social costs for a country. A combination of rising inflation and more people out of work implies a deterioration in economic performance and a rise in the misery index.”

Skeptical Bias Toward Stocks Aligns With Bullish Charts

Socionomics and the Misery Index

Socionomics is an area of study pioneered by Robert Prechter of Elliottwave International. It is the study of social mood and how it affects economics and politics. Traditional thought has it that good economic times cause euphoria and lead to investor optimism. Socionomic theory stands this on its head and says that investor sentiment is […]