The market has seen a definite resistance line since it first tested 2000 back in July. It’s second attempt to break through came in September and the third attempt came in late November and early December and now it is trying to break out to the upside once more. Note that the second attempt was two months after the first and third was a little over two months but this test is only one month after the previous one with a very sharp rebound. In today’s post Chris Ciovacco will look at the possibilities.

Warning: Fast Moving Market

As volatility decreases people get complacent and get in a rut things become “normal” and so they are less alert to the bear around the next corner waiting to maul them. In today’s article Jared Dillian, editor of Bull’s Eye Investor, looks at the effects this complacency can have on your investments.

Is This Lagging Sector Ready To Lead?

Investing is about probabilities. The improving fundamental and technicals in the housing sector tell us the odds of success in that sector are also improving. It should be noted that even if the weekly trends continue and homebuilders lead, that does not remove normal retracements and pullbacks from the equation. The odds of good things happening in homebuilders are better today than they were in early October.

The Plunge Protection Team Strikes Again

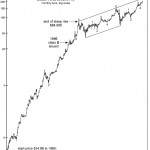

We have been expecting a major correction for quite some time now. In preparation for a market correction the index starts growing more slowly and then finally starts falling. Our NYSE Rate of Change (ROC) chart showed a slowing growth level and then generated a sell signal back in the first quarter of 2014. But […]

Could The S&P 500 Fall To 1,625?

A Trip Down Correction Memory Lane Since the correction-less market theory has been dropping transmission parts over the last three weeks, it is prudent to revisit some topics we have touched on in the past. We will focus on two questions: How far can stocks drop? How long can corrections last? History Says Corrections Can […]

Top Approaching in Berkshire Hathaway?

By Elliott Wave International Editor’s note: The following article originally appeared in a special September-October double issue of Robert Prechter’s Elliott Wave Theorist, one of the longest-running financial letters in the business. It piques our interest when a person or company makes the front page of a magazine or newspaper. On August 15, USA Today […]

Floating-Rate Funds Poised to Profit as Interest Rates Rise

Typically, as I’m sure you are aware interest rates and bond prices have an inverse relationship. That means when interest rates rise bond prices fall. But in today’s article we will look at a different type of bond fund that avoids that type of risk.

Anatomy Of A Stock Market Turn

Catch-22 Data Hits Tuesday Before we begin to examine the recent bottom in the stock market, investors were greeted with an eye-popping nugget of economic data Tuesday morning. From Reuters: The Commerce Department said on Tuesday durable goods orders, items ranging from toasters to aircraft that are meant to last three years or more, […]

Beware of Flashy Stock Repurchases When The Market Is on The Rise

Retail giant Bed Bath & Beyond just announced plans to buy back another $2 billion in shares, which the company will start doing after it completes its current share repurchase program. You’ve seen it before: Press releases emphasize that buybacks return value to shareholders, analysts sometimes rely on repurchases to spot a stock to write up next, and management likes to tout their focus on shareholder returns. But what’s the real story?

Adjusting Your Investments

Regular readers know our approach involves meticulously paying attention to known information about the markets and making allocation adjustments when conditions change. Small caps provide a recent example of how this approach can be helpful to investors and traders.