The Forex market remains a source of great opportunity for investors, thanks primarily to its high levels of leverage and liquidity. It is a margin based investment opportunity, which enables shrewd and experienced operators to gain returns that can dramatically exceed their initial financial commitment. But it also brings considerable risk, however, as less fortunate traders […]

Beware of Bears

The bearish case is beginning to make more and more sense. In my recent NASDAQ ROC stock commentary I warned that based on age alone the bull market is getting “long of tooth” and could generate a sell signal soon. And then we had Obama’s Comments Worry Stock Bulls showing how recent rhetoric by the President […]

Despite Weakness, Big Picture Remains Bullish

Bears Calling For Another Top Since the S&P 500 bottomed on June 24, the calls on Twitter for an imminent peak have been frequent. At some point a true trend reversal will come, but thus far Monday’s and Tuesday’s weakness can be placed in the normal volatility category. For the record, even as the S&P […]

Thoughts from the Frontline: Can It Get Any Better Than This?

What in the world is going on?! As I write this letter from the Maine woods, the S&P 500 has just cleared 1,700 for the first time. The German DAX continues to set all-time highs above 8,400. The United Kingdom’s FTSE 100 is quickly approaching its 1999 record high of 6,930, and its mid-cap cousin, […]

Is 2013 Stock Market 2007- Déjà Vu?

After seeing stocks drop over 50% in both the 2000-2003 and 2007-2009 bear markets, investors are understandably hesitant to redeploy their hard-earned money back into stocks. Given the up and down nature of the markets over the last three years, many assume a major peak in stocks must be right around the corner. Is there […]

Scared of Stocks? There Are Ways To Monitor Risk

‘Great Rotation’ Includes Safe Money Markets The equity side of Wall Street coined the term great rotation to describe what they hoped would be a mass migration by investors from bonds to stocks. Many investors have not forgotten when the S&P 500 plunged 50%-plus (2007-2009). From the Wall Street Journal: Investors are cashing out of […]

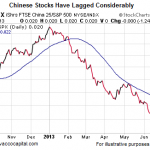

Too Many Bearish Flags To Ignore

As Chris notes in today’s post, bearish flags are proliferating with everything from Bonds to China to the S&P and even Gold taking a nose dive. So much for diversification. In the video Chris will take a look at where we stand. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM)~ […]

Gold and Silver: A Great Day to be a Bear

Elliott wave analysis is the blade-proof glove with which “to catch a falling knife” By Elliott Wave International In the wee morning hours before dawn on Thursday, June 20, the precious metals’ rooster crowed, “Cock-a-doodle-DOH!” It was the ultimate wake-up call: First, gold prices plummeted 4% then 5% then 6% below $1300 per ounce to […]

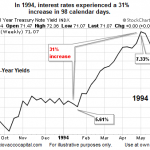

Will Raising Interest Rates Give Us a High Probability Short?

We know that rising interest rates are bad for bonds and gold and are considered good for stocks but in today’s article Chris Ciovacco looks at the effect rapidly rising interest rates can have on the stock market in the near future. ~Tim McMahon,editor 1994 Scenario: Market’s Worst Nightmare Spike in Rates Could Spook Stocks […]

Is LULU a Lemon of a Stock?

Today I am going to share with you one of my favorite technical tools and how to use this tool to successfully navigate the ups and downs of Lululemon Athletica Inc. (NASDAQ:LULU). Just recently, there has been a great deal of controversy about this company. You might recall the problem they had with their see-through […]