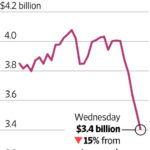

Crude oil took a 30% dive on Sunday, March 8. Yet what’s happened in oil this year is so much bigger than that headline-grabbing, one-day move. In January, oil was $64 a barrel. It hit $27.34 intraday on Monday, March 9, so the price of oil fell 57% in just two months. Talk about a swift decline.

Moving Averages Help You Define Trend – Here’s How

The “moving average” is a technical indicator of market strength which has stood the test of time.

Robert Prechter Talks About Elliott Waves and His New Book

It’s been a long time since we’ve offered you an article featuring Robert Prechter directly. We’re especially excited to offer you this thoughtful interview Avi Gilburt conducted with Bob.

Trump Bump Slaughters Market Bears

Much of the post-US election rally in the stock market has been attributed to President Donald Trump’s promises for tax cuts and deregulation. But long before the election, Elliott wave price patterns already told our subscribers to prepare for a market rally.

Elliott Waves Point to Market Probabilities

The “personality” of a third wave shows itself in recent market action. Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable. … Third waves usually generate the greatest volume and price movement … .

The U.S. Dollar’s 2014-2015 Rally

Let’s look at the 2014-15 Dollar rally and how the Elliott Wave Principle applies to Currencies and Foreign Exchange (Forex). I always say trading forex markets is like riding a bike — except that said bike has one flat tire and the ground beneath it is covered in ice.

So why is Forex so popular, you might ask? In fact, forex is the most liquid market on earth, where trillions of dollars change millions of hands every day.

The reason people are so willing to ride that bike — so to speak — is because if you can stay on, the rewards are often unmatched. The trick, of course, is staying on.

EURUSD: Why Recent Ups and Downs Are NOT Random

How do you know what “your” forex market will do tomorrow? You don’t. All anyone can do is guess. But some guesses are more “educated” than others…

“Markets are doing what they are supposed to be doing: inflicting the most pain on the most number of people. Markets fool the most number of people at the most unexpected moments, but by tracking Elliott wave patterns, sentiment (and the news) you can prepare yourself.”

Gold and Silver: A Great Day to be a Bear

Elliott wave analysis is the blade-proof glove with which “to catch a falling knife” By Elliott Wave International In the wee morning hours before dawn on Thursday, June 20, the precious metals’ rooster crowed, “Cock-a-doodle-DOH!” It was the ultimate wake-up call: First, gold prices plummeted 4% then 5% then 6% below $1300 per ounce to […]