Back in 2002 Gold was a hated asset. No one wanted it. Even though the tech wreck and dot-com bubble had burst no one wanted Gold. As I’ve said many times Gold is a crisis hedge more than an inflation hedge. And it is a good barometer for the fear of financial catastrophe. Contrarian newsletter […]

See Prechter’s “FREE FALL TERRITORY” Chart for Yourself

And see EWI’s long-term forecast in the updated “Free Fall” chart In the May 2008 issue of his monthly Elliott Wave Theorist, Robert Prechter showed this chart of the Dow Jones Industrials. As you can see, prices go back to the 1970s. Please note that on the day this chart published (May 16), the Dow […]

Trading the GDX Fibonacci Butterfly

There is a great deal of interest in trading Gold these days. And many different ways to do it. One method is using the Market Vectors Gold Miners ETF, symbol $GDX. Of course once you decide on the medium you still need a method of determining entry and exit points. In today’s article JW Jones […]

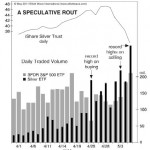

Is It Possible to Have Panic Buying?

What’s up with Silver lately? In this article Robert Folsom shows us what makes Silver tick and how it has gotten so crazy lately. Tim McMahon, Editor “Panic selling” is easy to understand and recognize: Investors rush to sell from the fear of loss. No more explanation necessary. On the other hand, “panic buying” is not […]

On the Docket: The Case Against Diversification

Talk with an investment advisor, and what’s the first piece of advice you will hear? Diversify your portfolio. The case for diversification is repeated so often that it’s come to be thought of as an indisputable rule. Hardly anyone makes the case against diversifying your portfolio. But because we believe that too much liquidity has […]

Gold Elliott Wave- How Long and How High?

In today’s editorial, David Banister takes a look at Gold and where it could be going. He provides an excellent possible scenario that matches with my views and experience exactly. He is projecting a rally to the $1500 range with a pull back from there and a major take-off for the final wave to the […]

Efficient Market Hypothesis: R.I.P.

Of all the belief systems of Wall Street, few can claim the devoted following of the Efficient Market Hypothesis, the idea that stock prices adhere to the same laws of supply-and-demand that govern retail products. Once coined the theoretical “Parthenon” of economics, this notion has consistently endured the test of time —– until now. Academics […]

Understanding Robert Prechter’s ‘Slope of Hope’

What’s the opposite of climbing the “wall of worry”? Now is a good time to learn why it’s called the slope of hope.