Which Works Best — GPS or Road Map? (Part 3) Trading with Elliott wave analysis By Elliott Wave International (Here are Part 1 and Part 2 of this article.) Think of Investing as a Trip Here’s my advice: View the Elliott wave Principle as your road map to the market and your investment idea as […]

Reading the Wave Analysis Map

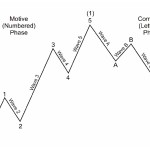

Which Works Best — GPS or Road Map? (Part 2) Trading with Elliott wave analysis By Elliott Wave International (Part 1 of this article is posted here.) A Quick Road Map of Wave Analysis For this overview of wave analysis, I have borrowed from the “Cliffs Notes” version that we provide for free to anyone […]

Fractal Geometry and the Stock Market

Which Works Best — GPS or Road Map? (Part 1) Trading with Elliott wave analysis By Elliott Wave International Some of the best stories about global positioning systems (GPS’s) are the weird detours they sometimes recommend to drivers. Just like some of the weird detours that financial markets can make you take when you think […]

(Video) Alcoa and Aluminum: Latest Price Action Suggests 2 Major Opportunities

Alcoa (NYSE:AA) and aluminum futures prices have “come into critical price areas.” By Elliott Wave International The editor of Elliott Wave International’s Metals Specialty Service, Mike Drakulich, has just recorded a new, free video forecast: “Aluminum and Alcoa: Exciting Juncture (Nov. 29, 2012.)” Says Mike (excerpt): “This is the first video of what is going […]

What Are Moving Averages and Why Should Investors Care?

The stock market, and the lingo associated with it, might as well be a foreign language to most Americans. Most people are not even sure how the stock market works or what it means, let alone what a “moving average” is. Simply, put a moving average is exactly what it implies: the average rate at […]

Bears in Control Until Charts Improve

In this article from Chris Ciovacco, the Chief Investment Officer for Ciovacco Capital Management, LLC we take a look at where the market is and where it is going. ~Tim McMahon, editor Bears in Control Until Charts Improve From a fundamental perspective, the markets have much to worry about with excessive debt in the United States […]

Market Patterns Repeat Themselves

The government mandats that the following words appear on Stock Market related solicitations, “Past performance is no guarantee of future results.” This wording is designed to warn us that markets are irratic and that no one has a perfect crystal ball. But in so doing they may sub-consciously convince us that the future is unknowable […]

Moving Averages and the Elliott Wave Principle

Improve your Elliott wave pattern identification skills with this lesson By Jeffrey Kennedy / Elliott Wave International Moving averages are one of the most widely-used methods of technical analysis because they are simple to use, and they work. Among Elliott wave traders, you will likely find an especially high percentage of investors and traders who incorporate […]

An Elliott Wave Pattern that Signals the Start of Opportunity

The size of the wave will surprise most everyone On Monday Oct. 8 I sat down with Elliott Wave International’s senior analyst Jeffrey Kennedy to discuss his favorite wave pattern of all: the Elliott wave diagonal. Nico Isaac: You say if you had to pick just ONE of all 13 known Elliott wave structures to […]

Technical Analysis

Technical Analysis- Despite the fancy and sophisticated tools it employs, technical analysis at its very core is a study of the market’s supply and demand to determine the price movement of a stock or other underlying asset in the future. Technical analysis premise rests on 3 theorems: The market discounts everything. An asset’s price moves […]