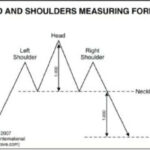

You are probably familiar with the classic “head and shoulders” chart pattern. But, in case you need a refresher, here’s a brief description of a head and shoulders top: The high of an initial upward move is the left shoulder. After a decline, another upward move takes prices to a higher high, or the head. A second decline follows the head. A third rally then takes prices to a peak below the high of the head, and becomes the right shoulder. The left and right shoulders are often similar in duration and extent. A trendline connecting the two lows is called the neckline. When prices penetrate the neckline, a change of trend is believed to have occurred. Head and shoulders bottoms also occur and the same description applies except in reverse. This head and shoulders measuring formula — showing a top as an example — provides even more insight. The commentary is from a past issue of Elliott Wave International’s Trader’s Classroom:

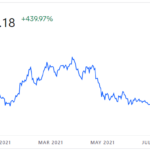

Will China’s Crackdown Send Bitcoin’s Price Tumbling?

Over the last year, bitcoin has increased by over 400%. As a matter of fact, it has more than doubled since the July low. In today’s article, we are going to look at whether news or even government actions affect the price of bitcoin. In the article, it refers to a proclamation made on July 2, where Elliottwave International says that the downtrend was ending… and then Bitcoin rose throughout July and August, fell through September (bottoming on September 28th), and then it began to rise again. ~Tim McMahon, editor.

Bitcoin: Let’s Put 2 Heart-Pounding Price Drops into Perspective

Bitcoin’s price fell hard, from above $58,000 to $45,000, and some are wondering if this is the start of a crash. Well, the word “crash” was also used back in January, when the cryptocurrency fell from $42,000 to below $30,000. However, prices bounced back. Let’s see how Elliott wave analysis can help put both price drops into perspective.

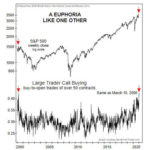

Why Most Investors Miss Major Stock Market Turns

Is Dow 100,000 just down the road? One financial commentator makes the case. At the same time, realize that extraordinarily bold forecasts usually occur at a particular juncture during a market’s trend. ~Tim McMahon, editor

Summer of Love for Gold Bulls: How “Quandary” Became Clarity

As mainstream experts struggled to see the direction in gold, Elliott wave analysis saw a clear, bullish triangle. Then, gold prices rocketed to six-year highs!

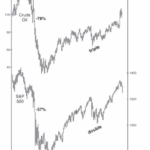

Are Falling Oil Prices Really Good for the Stock Market?

It makes sense that falling oil prices would be good for stocks, after all it should lower company’s cost for energy and therefore increase profitability. However, in October 2018 both Oil prices and Stock prices fell simultaneously. So, “What’s Up with that?” In today’s post the Editors at Elliott Wave International will look at the relationship between Oil and Stocks.

U.S. Stocks: A Sentiment Extreme You MUST Pay Attention to

Robert Kelley, the editor of Elliott Wave International’s US Stocks Intraday Pro Service, tells you about a sentiment extreme that he’s seen recently. Watch this new interview to find out what has caught his attention and what they mean for U.S. stocks going forward.

12 Real-Life Techniques That Will Make You a Better Trader Now

If you invest in the markets this is something to get excited about. Our friends at Elliott Wave International (EWI) have just released a free video-based resource, “12 Real-Life Techniques That Will Make You a Better Trader Now.” Over 5 free videos, EWI’s Master Instructor Jeffrey Kennedy gives you 12 battle-tested trading tips — 100% free.

Did You See the 30% Rise in This Major Global Stock Index?

In this video Robert Folsom shows the indicators leading the Hong Kong Hang Seng Index to gain 30% in 9 months.

Crude Oil Sinks 20% Despite OPEC Production Cuts

On January 1, the long-awaited agreement between OPEC and its major exporting partners like Russia to curtail production by 1.8 million barrels a day went into effect. And, according to the mainstream experts, the massive effort to cut the oil glut would also light the fire beneath oil prices. But that’s not what happened…