Don’t listen to the naysayers — there IS a way to forecast the general health of the economy. This method has repeatedly proven itself. Yes, you can anticipate the likelihood of a recession, even a depression — or, conversely, when major economic measures — like jobs — will be robust.

Robert Prechter Talks About Elliott Waves and His New Book

It’s been a long time since we’ve offered you an article featuring Robert Prechter directly. We’re especially excited to offer you this thoughtful interview Avi Gilburt conducted with Bob.

Why Choose the Wave Principle?

Robert Prechter reveals why he embraced the Wave Principle. Robert Prechter is the widely recognized authority on the Elliott Wave Principle. Read how he learned about the Wave Principle and why he embraced it in the edited excerpt from his book Prechter’s Perspective below (Q&A format): ——————– Question: What was it about Elliott that captured […]

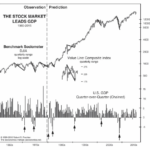

See Prechter’s “FREE FALL TERRITORY” Chart for Yourself

And see EWI’s long-term forecast in the updated “Free Fall” chart In the May 2008 issue of his monthly Elliott Wave Theorist, Robert Prechter showed this chart of the Dow Jones Industrials. As you can see, prices go back to the 1970s. Please note that on the day this chart published (May 16), the Dow […]

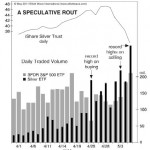

Is It Possible to Have Panic Buying?

What’s up with Silver lately? In this article Robert Folsom shows us what makes Silver tick and how it has gotten so crazy lately. Tim McMahon, Editor “Panic selling” is easy to understand and recognize: Investors rush to sell from the fear of loss. No more explanation necessary. On the other hand, “panic buying” is not […]

Slicing the Neckline: A Classic Technical Pattern Agrees with the Elliott Wave Count

In the August issue of his Elliott Wave Theorist, market forecaster Robert Prechter alerted readers that the U.S. stock market was slicing the neckline of a classic head-and-shoulders pattern in technical analysis, and that this may send the market into critical condition. Prechter said that when the Elliott wave count and a head-and-shoulders pattern are […]

Elliott Wave Tutorial

“Successful market timing depends upon learning the patterns of crowd behavior. By anticipating the crowd, you can avoid becoming a part of it.” I pulled this quote directly from the opening paragraphs of the free Elliott Wave Online Tutorial. It’s critical to your understanding of how markets really work. Now some might say, “What’s […]

Understanding Robert Prechter’s ‘Slope of Hope’

What’s the opposite of climbing the “wall of worry”? Now is a good time to learn why it’s called the slope of hope.

20 Questions with Robert Prechter: Long Decline Ahead

The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. Jim Puplava: I want to come back to government spending, but first I want to move onto the stock market. In your […]

20 Questions with Robert Prechter: Signs Point to Deflation

The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. To read the entire conversation, access the 20-page report here. Jim Puplava: Bob, I want to pick up from last September. Since […]