The Dow Jones Transportation Average has failed to print a new high above the previous high made in 2015. Given the Dow has made a new high, a Dow Theory non-confirmation remains in effect.

Technical vs. Fundamental Analysis? The Winner is…

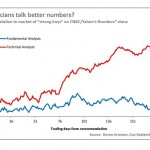

Technical versus fundamental analysis: Which approach yields better investment results? A new study by three finance professors offers an answer.

The focus of their study were a thousand pairs of recommendations made between November 2011 and December 2014 on the TV show “Talking Numbers” … The first half of each pair was a recommendation from a top technician about a stock in the news; the second half was a recommendation about that same stock from a leading fundamental analyst.

How to Use the Stochastic Oscillator

The stochastic oscillator is a popular tool for analyzing a market. Watch the video to learn how you can use this indicator in your trading. Another way to use Stochastic is as a trend analysis tool. In the following video Jeffrey gives a good explanation of the terms “overbought” and “oversold”. He says these two terms are responsible for more lost money among rookie traders than anything else. So watch the video and get some great tips on using stochastics in your trading.

Top Technical Tools and Videos:Candlesticks, RSI & MACD

Enhance your trading confidence with this lesson on how the top technical tools Japanese Candlesticks, RSI and MACD By Elliott Wave International “Guessing or going by gut instinct won’t work over the long run. If you don’t have a defined trading methodology, then you don’t have a way to know what constitutes a buy or […]

Technical Analysis

Technical Analysis- Despite the fancy and sophisticated tools it employs, technical analysis at its very core is a study of the market’s supply and demand to determine the price movement of a stock or other underlying asset in the future. Technical analysis premise rests on 3 theorems: The market discounts everything. An asset’s price moves […]

S&P 500: Did the 13.74-Point Rally Finish the Move?

Here’s what Elliott wave analysis is all about: You study charts to find non-overlapping 5-wave moves (trend-defining) from overlapping 3-wave ones (corrective, countertrend). With that in mind, please take a look at this chart of the S&P 500. Immediately, you can see that the S&P 500 has been moving sideways in a choppy, overlapping manner. […]

Forex Trading Software

Trading Forex Many investors in recent years have decided to branch out and venture into the foreign exchange market as a way to diversify their investment strategies, and bring in extra profits. If you’ve been thinking about investing in the Forex market, there are several concepts that you have to understand before you can have […]

Trading the Line

How a Simple Line Can Improve Your Trading Success Elliott Wave International’s Jeffrey Kennedy explains many ways to use this basic tool The following trading lesson has been adapted from Jeffrey Kennedy’s eBook, Trading the Line — 5 Ways You Can Use Trendlines to Improve Your Trading Decisions. You can download the 14-page eBook here. […]

How to Identify and Use Support and Resistance Levels

Since 1999, Elliott Wave International senior analyst and trading instructor Jeffrey Kennedy has produced dozens of Trader’s Classroom lessons exclusively for his subscribers. While commodity markets are known as some of the toughest trading environments around, these actionable lessons from a skilled veteran can help you trade commodities, or any market for that matter, with […]

Hooking Potential Trade Set-ups

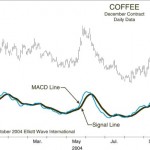

How to Combine Technical Indicators with Elliott Wave Analysis By Elliott Wave International Trading using technical indicators — such as the MACD, for example, Moving Average Convergence-Divergence — can do one of two things: help you or hinder you. Using them as a forecasting method alone can be about as predictable as flipping a coin. […]