Pictures Are Worth A Thousand Words

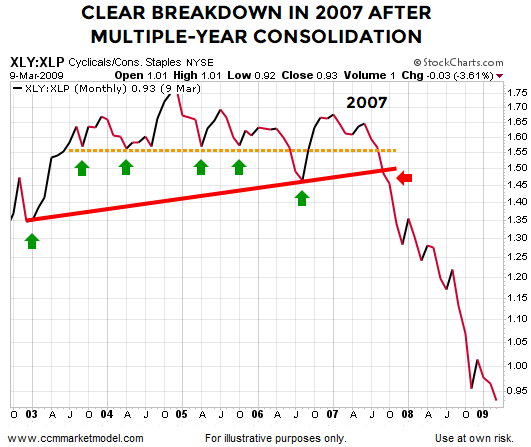

When investors are confident about future economic outcomes, they tend to prefer growth-oriented XLY (consumer discretionary) over defensive-oriented XLP (consumer staples). The 2002-2009 chart below shows the XLY:XLP ratio consolidated for several years before breaking down in October 2007.

This Picture Looks Quite A Bit Different

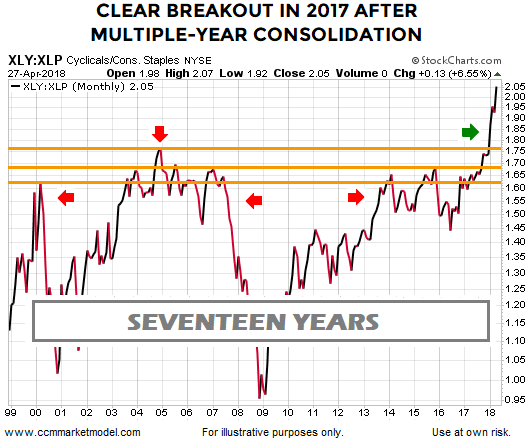

In the present day scenario, the XLY:XLP also consolidated for a number of years. The ratio was unable to exceed the orange lines between 2000 and late 2017. Instead of breaking down in a bearish manner (see October 2007 above), the ratio broke out in a bullish manner in late 2017 by exceeding the levels that had acted as resistance for roughly 17 years.

The charts above tell us quite a bit about the market’s tolerance for risk in late 2007 relative to the market’s tolerance for risk in 2018. Even in the face of recent broader market weakness/consolidation, the ratio is up 6.55% for the month as of April 27.

Does Broader Asset Class Behavior Paint A More Concerning Picture?

Is the XLY:XLP ratio the only ratio that paints a “be open to better than expected long-term outcomes” picture? To help answer that question, this week’s video covers over 20 ETFs, allowing us to understand the market’s message via broad asset class behavior.

Monday’s Economic Data

Chicago PMI came in at 57.6. Any reading over 50 indicates improving economic conditions. From The Wall Street Journal:

“WASHINGTON—Americans’ spending bounced back in March, while their incomes continued to grow, a sign consumers could drive better economic growth this year.”

This article by Chris Ciovacco of Ciovacco Capital Management originally appeared here and has been reprinted by permission.

You might also like:

- Are Wars Bullish or Bearish for Stocks?

- Tariffs May Not Slow Profit Momentum

- Will Rising Bond Yields Send Stock Prices Tumbling?

- This Chart Says to Be Open to Better than Expected Market Outcomes

- Stocks Can’t Keep Going Up Forever… Or Can They?

- New Long-Term Equity Breakout

Speak Your Mind