Almost exactly a year ago, oil prices went negative $40. Today, with crude trading at $60, you’re hearing lots of opinions as to what’s next. “Electric car revolution” … “reopening economy” … “end of commute” … “start of travel season” … bullish … bearish … who’s right? … who’s wrong?

You’re invited: Spot the Next BIG Move in Oil, Gas, Energy ETFs (April 7-14)

Crude Oil’s 2020 Crash: See What Helped (Some) Traders Pivot Just in Time

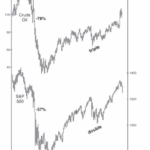

Since the start of 2020, crude oil has gone from “black gold” to “black days,” plummeting 70% for its “worst quarter on record”. As of March 30, oil prices circled the drain of a two-DECADE low near $20 per barrel. Is there any way an oil trader or active oil investor could look at the market’s crash and NOT see what one March 12 CNN article coined “a nightmare scenario”?

Did the Oil Crash Wreck the Stock Market?

Crude oil took a 30% dive on Sunday, March 8. Yet what’s happened in oil this year is so much bigger than that headline-grabbing, one-day move. In January, oil was $64 a barrel. It hit $27.34 intraday on Monday, March 9, so the price of oil fell 57% in just two months. Talk about a swift decline.

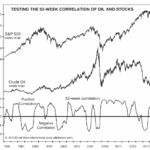

Are Falling Oil Prices Really Good for the Stock Market?

It makes sense that falling oil prices would be good for stocks, after all it should lower company’s cost for energy and therefore increase profitability. However, in October 2018 both Oil prices and Stock prices fell simultaneously. So, “What’s Up with that?” In today’s post the Editors at Elliott Wave International will look at the relationship between Oil and Stocks.

Crude Oil Sinks 20% Despite OPEC Production Cuts

On January 1, the long-awaited agreement between OPEC and its major exporting partners like Russia to curtail production by 1.8 million barrels a day went into effect. And, according to the mainstream experts, the massive effort to cut the oil glut would also light the fire beneath oil prices. But that’s not what happened…

These Crisis Markets Are Primed to Deliver Big Gains

Justin Spittler, editor of The Daily Dispatch is talking with Crisis Investing editor Nick Giambruno. Nick shares two key markets he’s keeping an eye on today…

WTI Crude Oil on the Move $112 Next Stop

The energy sector has surged during the last two months which can be seen by looking at the XLE Energy Select Sector Fund. If crude oil continues to climb to the $112 level, XLE will likely continue to rally for another few days or possibly week as energy stocks are considered a leveraged way to […]

Three Investment Sectors Ripe for Speculation in 2013

With sovereign economies around the world still trying to find their footing after the global financial crisis of 2008, investors are looking at industries and investment sectors that will present opportunities for speculation and profit in 2013. Although the economy of the United States is far from a full recovery, Wall Street has reacted positively to […]

Oil and Gas Stocks

Oil and gas along with their equities have been underperforming for the most part of 2012 and they are still under heavy selling pressure. I watch the oil futures chart very closely for price and volume action. And the one thing that is clear for oil is that big sellers are still unloading copious amounts […]

Technicals vs. Fundamentals: Which are Best When Trading Crude Oil and Natural Gas?

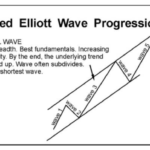

If “fundamentals” drive trend changes in financial markets, then shouldn’t the same factors have consistent effects on prices? For example: Positive economic data should ignite a rally, while negative news should initiate decline. In the real world, though, this is hardly the case. Just read these four oil price headlines from July 22 and 23. (And get FREE access to EWI’s latest energy market forecasts!)