Sentiment indicators… can tell you the extent to which [people] are extremely optimistic or pessimistic. Well, 2021 was a year like no other. Finally, in December 2021, I put out an issue called “A Stock Market Top for the Ages.”

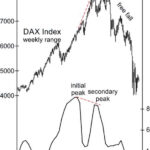

Germany’s DAX: What You Can Learn from the 2007 Top

This stock market indicator may be off many investors’ radar but a peak in consumer confidence tends to precede a peak in the stock market. With that in mind, back on Nov. 25, the Telegraph said: Consumer confidence has dropped sharply in Germany. … A few days later, the December Global Market Perspective, a monthly Elliott Wave International publication that offers coverage of 50-plus worldwide financial markets, provided a retrospective of Germany’s DAX and consumer confidence with this chart and commentary:

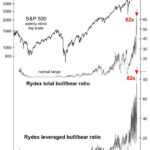

Market Participants are Extremely Bullish

With the current political upheaval in this country, it is difficult to see how the market can be so bullish. In today’s article by Elliott Wave International, we see that the market has “Great Expectations” for 2021. But as we saw in the previous article, Why Most Investors Miss Major Stock Market Turns, often when market-participants are most bullish is at the peak. And its not just amateurs that make this mistake, even “professionals” get caught up in the euphoria. This makes sense in a strange sort of way. When everyone is “fully invested” there is no more money left to flow into the market so it has to go down. And when everyone has taken their money out of the market and put it in “safe cash” there is plenty of money available to drive the market up. Recently Forbes published an article entitled 4 Stock Market Sentiment Indicators: Euphoric-Plus. The old market adage “when everyone else is buying you should be selling” might apply here. Also at the end of this article, you can get free access to the online version (really free- no shipping) of the Elliott Wave Classic, Elliott Wave Principle: Key to Market Behavior ~Tim McMahon, editor

U.S. Stocks: A Sentiment Extreme You MUST Pay Attention to

Robert Kelley, the editor of Elliott Wave International’s US Stocks Intraday Pro Service, tells you about a sentiment extreme that he’s seen recently. Watch this new interview to find out what has caught his attention and what they mean for U.S. stocks going forward.

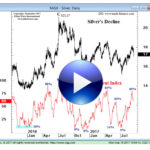

Silver Chart of the Day

Silver has had several major peaks over the last year. But interestingly sentiment has been an excellent indicator of peaks. In this video we will look at the correlation between Silver’s price and market sentiment.

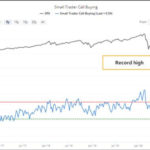

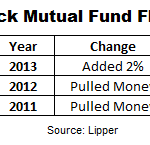

Have All the “Buyers” Already Bought?

In a Bull market that is appreciating sharply, greed begins to take over and people begin speculating with money they can’t afford to lose. Logic would dictate that when it gets extremely bullish everyone who is going to buy has already bought and so with no one left to buy the market falls. And when the market falls […]

Market Sentiment Analysis: Spotting a Shift in Sentiment is Key

Don’t follow the crowd- By analyzing market sentiment astute traders can spot subtle shifts ahead of the crowd in order to open the floodgates to massive profits. We’ve all heard the old mantra “Buy Low, Sell High” but logically that means that we have to buy when everyone else is selling or better yet, after everyone […]

The Investor’s Battle Between Hope and Fear

Editor’s Note: It has long been said that the key to successful investing is to be greedy when others are fearful and fearful when others are greedy. This is excellent advice if you have the fortitude to actually do it. If you succeed you will get out of the market when even the bag-boys at the supermarket […]