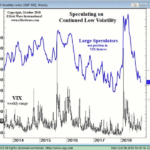

The stock market’s volatility from late July through early October was extraordinarily low. For 50 straight days the S&P 500 had not closed more than 0.8% in either direction, the longest such streak since 1968.

Yet, on October 3, all that changed. The markets dropped hard… and the VIX suddenly spiked even harder.

Watch This Indicator for Approaching Volatility

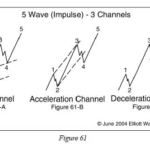

A Method Traders Can Use to Confirm an Elliott Wave Count

By Elliott Wave International When you are watching a pattern develop on a chart, how can you be sure that your Elliott wave count is correct? Elliott Wave International’s Senior Analyst Jeffrey Kennedy spent years designing his own technique to improve his accuracy. He came up with the Kennedy Channeling Technique, which he uses to […]

12 Real-Life Techniques That Will Make You a Better Trader Now

If you invest in the markets this is something to get excited about. Our friends at Elliott Wave International (EWI) have just released a free video-based resource, “12 Real-Life Techniques That Will Make You a Better Trader Now.” Over 5 free videos, EWI’s Master Instructor Jeffrey Kennedy gives you 12 battle-tested trading tips — 100% free.

Gold: Often, Simple Forecasting Tools Are All You Need

In the following video by Elliott Wave International we will look at the gold price and “Commitment of Traders” In 2017, Gold ‘s rally has stalled three times in April, June and August. With April and June’s price stalling at the same overhead resistance level. Back in August Elliott Wave TV said, When analyzing charts […]

Is Silver Worth Buying in 2017?

Silver investments have a sketchy past. Recently, it came to light that from 2007 to 2013 major players like JP Morgan Chase and HSBC, had been manipulating the price of silver. But that is not the first time the price of silver was manipulated. Beginning in the early 1970s, the Hunt brothers, Nelson, William and Lamar began accumulating large amounts of silver. Until his dying day in 2014, Nelson Bunker Hunt, who had once been the world’s wealthiest man, denied that he and his brothers had plotted to corner the global silver market. Whether they initially intended to “corner the market” or just believed in the ability of silver to protect against double-digit inflation is uncertain but by 1979, they had nearly cornered the global silver market.

In 1979, the brothers had made a profit of from $2 to $4 billion in silver speculation, with estimated silver holdings of 100 million troy ounces (3,100,000 kg). Because the Hunt brothers held the majority of the available above ground supply, silver prices soared from $11 an ounce in September 1979 to $50 an ounce in January 1980. However, like all bubbles this one popped as well, (in this case with the possible help of the government due to the difficulties caused by the lack of supply of silver) with prices falling back to $11 by March 1980. Eventually the Hunt brothers were forced to file for bankruptcy due to lawsuits related to their trading activities. Some see the endearingly eccentric Texans as the victims of overstepping regulators and vindictive insiders who couldn’t stand the thought of being played by a couple of southern yokels.

Even today, many investors still prefer to invest in gold rather than silver. However, 2017 is a shiny new year by many standards. Is this the year to buy silver?

Market Trends Diverging

Today we are going to take a look at two common stock market charts that individually tell opposite stories but when combined give us an interesting insight into the overall market. The first chart is the S&P 500. As I’m sure you are aware the S&P 500 represents Standard and Poor’s top 500 companies.

The Plunge Protection Team Strikes Again

We have been expecting a major correction for quite some time now. In preparation for a market correction the index starts growing more slowly and then finally starts falling. Our NYSE Rate of Change (ROC) chart showed a slowing growth level and then generated a sell signal back in the first quarter of 2014. But […]

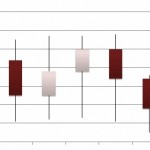

How to Find Trading Opportunities in ANY Market Using Candlesticks (Video)

Candle stick patterns are believed to be first developed by Japanese rice merchants hundreds of years ago but it wasn’t until recently that they began to catch on here in the United States. But they seem to be replacing the traditional Open, High, Low, Close (OHLC) stick figure format, perhaps because they provide a bit […]

What is the Yield Curve and What Others Are Saying About It

What is the Yield Curve? The yield curve is a graphical representation of several “yields” or interest rates over varying contract lengths i.e. 1 month, 2 months, 3 months, 1 year, 2 years, 10 years, etc… The curve shows the relationship between the interest rate or cost of borrowing and the time to maturity. For example, interest rates paid on […]

Investors vs. Traders and Precious Metals

The precious metals market is but a fraction of the size of the either the stock or bond market and so if even a small portion of either of these markets were to move into precious metals i.e. Gold, Silver or Platinum it could move that market drastically. Many investment advisers recommend having 5-10% of your investment portfolio […]