Karen went from her day-job as an accountant to $41 Million in Profit In this video we look at how a former accountant named karen, went from having Merrill Lynch manage her retirement account and getting basically nowhere, to managing her own account and generating $41 million dollars in profit in only three years. And to […]

Market Patterns Repeat Themselves

The government mandats that the following words appear on Stock Market related solicitations, “Past performance is no guarantee of future results.” This wording is designed to warn us that markets are irratic and that no one has a perfect crystal ball. But in so doing they may sub-consciously convince us that the future is unknowable […]

Fixed Annuities vs. Permanent Life Insurance

Fixed Annuities vs. Permanent Life Insurance – Which is better? The short answer is that neither is better, both serve unique purposes in your overall investment scheme and both may be necessary. An annuity is an insurance product that pays out income and is usually used as a part of your retirement strategy. If you are looking for […]

Socionomics and the Misery Index

Socionomics is an area of study pioneered by Robert Prechter of Elliottwave International. It is the study of social mood and how it affects economics and politics. Traditional thought has it that good economic times cause euphoria and lead to investor optimism. Socionomic theory stands this on its head and says that investor sentiment is […]

Gold the Ultimate Hedge Against Uncertainty

Back in 2002 Gold was a hated asset. No one wanted it. Even though the tech wreck and dot-com bubble had burst no one wanted Gold. As I’ve said many times Gold is a crisis hedge more than an inflation hedge. And it is a good barometer for the fear of financial catastrophe. Contrarian newsletter […]

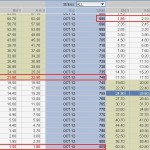

Trading the GDX Fibonacci Butterfly

There is a great deal of interest in trading Gold these days. And many different ways to do it. One method is using the Market Vectors Gold Miners ETF, symbol $GDX. Of course once you decide on the medium you still need a method of determining entry and exit points. In today’s article JW Jones […]