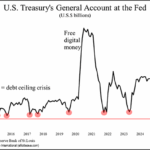

What’s another few trillion dollars? U.S. debt is already approaching a historic $37 trillion and now, Congress is discussing adding at least another $3 trillion to the “debt ceiling.” Yes, that’s the phrase that many hear on the news but know little about. Our June Global Rates & Money Flows sheds some historic light on the topic:Get ready for a summer of apprehension in America as the financial markets fixate on the level of U.S. Federal government debt and whether lawmakers allow the legal limit on it to be (once again) raised. What is the “debt ceiling” and does it really matter?

This Trend Will Likely Soon Rock the U.S. Financial System

Nearly everyone who buys groceries, fills their car tank with gas, pays rent, buys car insurance and so on is talking about the high cost of living. And it’s true that consumer price inflation is higher today than before the pandemic – although, it’s nowhere near as high as it was two years ago, when the annual inflation rate spiked to a 40-year peak of 9.1%.

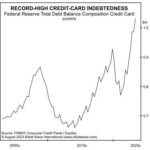

Why You Should Expect a Once-in-a-Lifetime Debt Crisis

The following article by Elliott Wave International looks at the possible impact of the building debt crisis. We’ve all heard about the massive problem of College debt created by the easy-money policies of the government. But today we are looking at the impact of the massive credit card debt.

Is a Pension Fund Crisis Next?

Many public pensions suffer from funding shortfalls. In other words, they don’t have nearly enough money to meet their obligations. More than that, investments are being made in potentially financially dangerous assets to boost returns, such as private equity.

Silicon Valley Bank, Silvergate and “The Everything Bust”

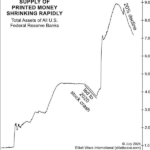

the FED’s raising interest rates has resulted in an “inverted yield curve” (i.e. short rates are higher than long interest rates) which puts extreme stress on banks and has resulted in some recent bank failures. In this article, the editors of Elliott Wave International look at the banking situation. ~Tim McMahon, editor

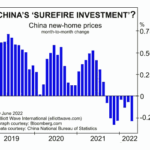

What the “Housing Busts” Indicator Is Saying Now

The housing market tends to go the way of the stock market, and nearly everyone knows that the stock market has been sliding… Homes sales have already begun to decline:

U.S. existing home sales fall for third straight month; house prices at record high (Reuters, May 19)

Sales of existing homes fell in May, and more declines are expected (CNBC, June 21)

Sales of luxury homes in some areas have dropped significantly. As examples, in Nassau County, NY, Oakland, CA, Dallas, TX, Austin, TX and West Palm Beach, FL, annual drops in the rate of upper-end home sales for the three months ended April 30 stretched from 32.8% to 45.3%.

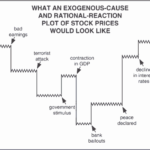

Why Investors are Consistently Fooled by the Stock Market

Stock market observers are trying to “make sense” of the wild price moves, which have mainly been to the downside.

As a May 12 CNBC headline says:

Traders search for answers as relentless selling on Wall Street looks to be detached from reality

Many market participants believe the “reality” of economic statistics, earnings and other factors external to the market govern the market’s trend.

However, that’s a fallacy.

Let’s get insights from a classic Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and social trends: