The following article was written by Gary Tanashian editor of Notes From The Rabbit Hole (NFTRH) and originally appeared here. In it Gary looks at the current “Dysfunctional Market” the FED manipulation called “Operation Twist” that caused it along with Gold, Silver, plus inflation and deflation. I like his quote about the effects of inflation, “Funny money on the run… is not discriminating money. It seeks assets… period.” and he holds that that is the primary reason why the stock market has risen since 2011.

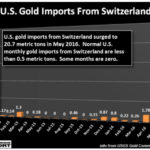

Something Strange in the Gold Market

Gold has a strong negative correlation to other assets. That means that when other markets fall gold can hold steady or even rise. This makes it the ultimate portfolio insurance.

Elliott Wave Projecting Gold Bottom?

By David A Banister We have been writing about the bottoming process of the Gold Bear Cycle (Elliott Wave Theory) since December 4th 2013, and our most recent article on December 26th reiterated that the best time to accumulate the Gold/Silver stocks was in the December and January window. Specifically this is what we wrote: […]

Gold and Silver: A Great Day to be a Bear

Elliott wave analysis is the blade-proof glove with which “to catch a falling knife” By Elliott Wave International In the wee morning hours before dawn on Thursday, June 20, the precious metals’ rooster crowed, “Cock-a-doodle-DOH!” It was the ultimate wake-up call: First, gold prices plummeted 4% then 5% then 6% below $1300 per ounce to […]

Investors vs. Traders and Precious Metals

The precious metals market is but a fraction of the size of the either the stock or bond market and so if even a small portion of either of these markets were to move into precious metals i.e. Gold, Silver or Platinum it could move that market drastically. Many investment advisers recommend having 5-10% of your investment portfolio […]

Fibonacci Clusters Show Important Resistance Level in Gold

Senior Analyst Jeffrey Kennedy shares techniques that helped spot a trading opportunity. By Elliott Wave International If you use Elliott in your technical analysis, you may already use Fibonacci ratios to determine targets and retracement levels in your charts. But have you heard of “Fibonacci Clusters?” Elliott Wave Junctures editor Jeffrey Kennedy shares his charts […]

Three Investment Sectors Ripe for Speculation in 2013

With sovereign economies around the world still trying to find their footing after the global financial crisis of 2008, investors are looking at industries and investment sectors that will present opportunities for speculation and profit in 2013. Although the economy of the United States is far from a full recovery, Wall Street has reacted positively to […]

Gold to Enter 5th Wave- Up, Up, Up

Editor’s Note: Many people have been wondering what’s up with Gold. Why has it been performing so poorly over the last year? Well, In today’s article David Banister explains what has been happening in terms of Elliott waves and gives us a good explaination of where it will be heading over the next year or so. […]

Gold the Ultimate Hedge Against Uncertainty

Back in 2002 Gold was a hated asset. No one wanted it. Even though the tech wreck and dot-com bubble had burst no one wanted Gold. As I’ve said many times Gold is a crisis hedge more than an inflation hedge. And it is a good barometer for the fear of financial catastrophe. Contrarian newsletter […]

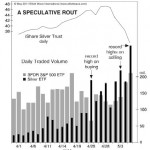

Is It Possible to Have Panic Buying?

What’s up with Silver lately? In this article Robert Folsom shows us what makes Silver tick and how it has gotten so crazy lately. Tim McMahon, Editor “Panic selling” is easy to understand and recognize: Investors rush to sell from the fear of loss. No more explanation necessary. On the other hand, “panic buying” is not […]