The fear of missing out (FOMO) is a powerful narcotic that often affects market participants near the top of a cycle. And before long, you hear the “bag-boy” at the supermarket bragging about his “portfolio”. When that happens it is time to follow Warren Buffet’s sage advice and “Be fearful when everyone else is greedy and greedy when everyone else is fearful.”

Is the Buying Opportunity Here Yet?

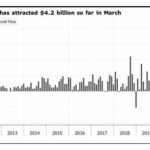

With the market down so sharply many are speculating that it will rebound just as sharply but market sentiment might be indicating something else altogether.

Elliott Wave: Market Signaling Fed to Cut Rates Soon

Our friends at Elliott Wave International (EWI) have been tracking the U.S. Federal Reserve’s interest rates decisions for years. This week, the Fed once again decided to keep the funds rate unchanged. But based on EWI’s analysis they expect the Fed to change course soon. They have covered this topic before, see: Want to Know […]

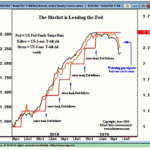

Traders Should Stay Optimistically Cautious

So far, the research team, at The Technical Trades Ltd., has been calling this market move quite accurately. On September 17, 2018, they called for a -5~8% downside market rotation, followed by price support just before the November 2018 US elections. After that, they called for a deep “Ultimate Low” price rotation followed by a strong price rally. Even though they under-estimated the depth of the correction their trend predictions from 120 days earlier played out quite accurately. So here is what they are currently saying.

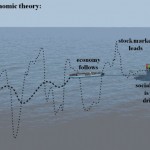

Charts Say Stocks Could Rise For 10-15 Years

With busy lives and a constant barrage of new information, many investors have a somewhat limited view of history from a financial markets/economic/political perspective. Albert Einstein reminds us of the benefits of taking a step back to review the bigger picture in a longer-term historical context:

“Somebody who only reads newspapers and at best books of contemporary authors looks to me like an extremely nearsighted person who scorns eyeglasses. He is completely dependent on the prejudices and fashions of his times, since he never gets to see or hear anything else.” Albert Einstein

Market Trends Diverging

Today we are going to take a look at two common stock market charts that individually tell opposite stories but when combined give us an interesting insight into the overall market. The first chart is the S&P 500. As I’m sure you are aware the S&P 500 represents Standard and Poor’s top 500 companies.