You know that there are hundreds of technical indicators out there. Sometimes you may have so many flashing signals on your screen that it looks like the motherboard of the Starship Enterprise. Here’s help in choosing the right one. In this free video lesson, the editor of Elliottwave International’s “Trader’s Classroom” service shows his favorite moving average pattern: the “Pinch.”

Moving Averages Help You Define Trend – Here’s How

The “moving average” is a technical indicator of market strength which has stood the test of time.

Learning to Recognize Trade Setups with “MACD”

According to Investopedia – the Moving Average Convergence Divergence (aka. MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA.

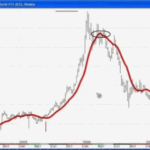

How Does 2016 Compare To Stock Market Peaks In 2000 And 2007?

How does the current 50 day and 200 day moving average on the S&P 500 compare from previous crashes with the current market situation?

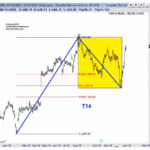

Spot High-Confidence Trading Opportunities Using Moving Averages

High confidence trading opportunities are those trade set-ups that have a high probability of resulting in a profitable trade. Of course, not every trade will be profitable but finding those with the best chance for success will put the odds in your favor. In previous issues we have looked at a variety of ways […]

Navigating A Fed-Dependent Market

Experienced traders and investors respect and understand the concept of “Don’t fight the Fed”. The basic rationale behind the expression is that when the Fed is printing money, the odds are tilted in the bulls’ favor. Conversely, when the Fed is tightening policy, bearish odds begin to pick up. What Fight Are We Trying To […]

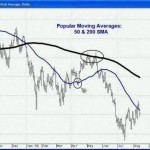

Moving Averages Can Identify a Trade

These 3 charts help you understand how moving averages work Moving averages are a popular tool for technical traders because they can “smooth” price fluctuations in any chart. EWI Senior Analyst Jeffrey Kennedy gives a clear definition: “A moving average is simply the average value of data over a specified time period, and it is […]

What Are Moving Averages and Why Should Investors Care?

The stock market, and the lingo associated with it, might as well be a foreign language to most Americans. Most people are not even sure how the stock market works or what it means, let alone what a “moving average” is. Simply, put a moving average is exactly what it implies: the average rate at […]

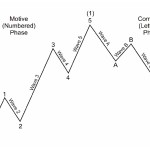

Moving Averages and the Elliott Wave Principle

Improve your Elliott wave pattern identification skills with this lesson By Jeffrey Kennedy / Elliott Wave International Moving averages are one of the most widely-used methods of technical analysis because they are simple to use, and they work. Among Elliott wave traders, you will likely find an especially high percentage of investors and traders who incorporate […]

What is a Moving Average?

Investing Using Moving Averages When investing in financial markets, there are many different indicators and systems that you can use to determine when to enter into a position, and just as importantly, when to exit a position. One of the most popular indicators that investors employ to help make intelligent decisions are moving averages. What […]