The stock market is nearing the typical length for a bull market and today Chris Ciovacco shows us four reasons caution is advised regarding the current market.

Flexibility Important During Indecisive Periods

The Fundamentals are Reflected in the Charts The market’s pricing mechanism, is based on the aggregate opinion of every investor around the globe and thus allows us to compare economic confidence in late 2007 to the present day. A more direct way to say it is “charts enable us to monitor the conviction that stocks […]

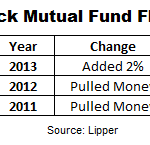

Have All the “Buyers” Already Bought?

In a Bull market that is appreciating sharply, greed begins to take over and people begin speculating with money they can’t afford to lose. Logic would dictate that when it gets extremely bullish everyone who is going to buy has already bought and so with no one left to buy the market falls. And when the market falls […]

Beware of Bears

The bearish case is beginning to make more and more sense. In my recent NASDAQ ROC stock commentary I warned that based on age alone the bull market is getting “long of tooth” and could generate a sell signal soon. And then we had Obama’s Comments Worry Stock Bulls showing how recent rhetoric by the President […]

Despite Weakness, Big Picture Remains Bullish

Bears Calling For Another Top Since the S&P 500 bottomed on June 24, the calls on Twitter for an imminent peak have been frequent. At some point a true trend reversal will come, but thus far Monday’s and Tuesday’s weakness can be placed in the normal volatility category. For the record, even as the S&P […]

Is 2013 Stock Market 2007- Déjà Vu?

After seeing stocks drop over 50% in both the 2000-2003 and 2007-2009 bear markets, investors are understandably hesitant to redeploy their hard-earned money back into stocks. Given the up and down nature of the markets over the last three years, many assume a major peak in stocks must be right around the corner. Is there […]

Scared of Stocks? There Are Ways To Monitor Risk

‘Great Rotation’ Includes Safe Money Markets The equity side of Wall Street coined the term great rotation to describe what they hoped would be a mass migration by investors from bonds to stocks. Many investors have not forgotten when the S&P 500 plunged 50%-plus (2007-2009). From the Wall Street Journal: Investors are cashing out of […]

Fed Misstep Opens Weak Economy Door

Ben Had Just Reestablished Order After tapering comments spooked the markets in May, Ben Bernanke spent weeks trying to jawbone the markets back into a calmer state. He was successful for the most part with the S&P 500 gaining 132 points off the June low. Fed Tests Ideas In Print If you want to read […]

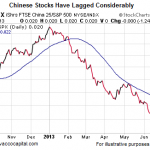

Too Many Bearish Flags To Ignore

As Chris notes in today’s post, bearish flags are proliferating with everything from Bonds to China to the S&P and even Gold taking a nose dive. So much for diversification. In the video Chris will take a look at where we stand. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM)~ […]

Navigating A Fed-Dependent Market

Experienced traders and investors respect and understand the concept of “Don’t fight the Fed”. The basic rationale behind the expression is that when the Fed is printing money, the odds are tilted in the bulls’ favor. Conversely, when the Fed is tightening policy, bearish odds begin to pick up. What Fight Are We Trying To […]