The first distinction in Elliott Wave Analysis is between “motive” and “corrective” waves. The primary focus of this lesson is the corrective waves. Corrective waves can be either “ZigZag”, “Flat” or “Triangle”.

What Stock Market Bulls Might Be Overlooking- Video

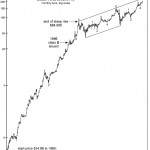

A growing economy is not necessarily bullish — see for yourself. If a strong economy means a strong stock market, then stocks should have continued higher in 2007 when GDP expanded at 2.7%, unemployment was 4.6% and Consumer confidence was very strong, . They didn’t, instead the Dow fell more than 50% over the next year and a half:

Warren Buffett says, The Market is a “Drunken Psycho”

When we look at the recent volatility of the market it is easy to become depressed, confused or just plain frustrated (or perhaps even a little of each). Even the legendary investor Warren Buffet says the market is like a “Drunken Psycho”, so what are mere mortals like ourselves to do? In today’s post we get a little peek into how to beat the market.

Using Trend Lines and Identifying Support and Resistance

One of the most basic skills necessary when looking at a stock chart is using trend lines and identifying support and resistance. Unfortunately, sometimes as we learn more sophisticated methods we tend to forget the basics. So if you are just starting in the markets or you are a more advanced trader, you may find this information valuable.

Top Approaching in Berkshire Hathaway?

By Elliott Wave International Editor’s note: The following article originally appeared in a special September-October double issue of Robert Prechter’s Elliott Wave Theorist, one of the longest-running financial letters in the business. It piques our interest when a person or company makes the front page of a magazine or newspaper. On August 15, USA Today […]

How to Find Trading Opportunities in ANY Market: Fibonacci Analysis

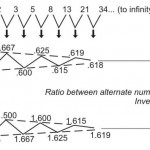

The primary Fibonacci ratios that I use in identifying wave retracements are .236, .382, .500, .618 and .786. Some of you might say that .500 and .786 are not Fibonacci ratios; well, it’s all in the math. If you divide the second month of Leonardo’s rabbit example by the third month, the answer is .500, 1 divided by 2; .786 is simply the square root of .618.

15 Hand-Picked Charts to Help You See What’s Coming in the Markets

Everyone uses gas: See this chart that shows why its price is heading lower By Elliott Wave International Have you ever seen price charts that tell a story clearly? Here is a perfect example from Robert Prechter’s most recent monthly publication, The Elliott Wave Theorist. By combining headlines from newspapers with the price chart for […]

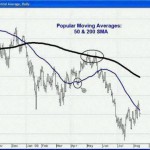

Spot High-Confidence Trading Opportunities Using Moving Averages

High confidence trading opportunities are those trade set-ups that have a high probability of resulting in a profitable trade. Of course, not every trade will be profitable but finding those with the best chance for success will put the odds in your favor. In previous issues we have looked at a variety of ways […]

How to Identify Turning Points in Your Charts Using Fibonacci

Leonardo Fibonacci (aka. Leonardo of Pisa) was the son of a merchant and well educated in the use of numbers while keeping his father’s books but in those days all of Europe used “Roman Numerals” and calculations were difficult. Leonardo was instrumental in bringing the Arabic numeral that we use today to Europe. But although […]