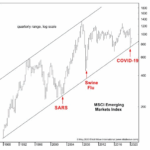

The global disruption associated with the pandemic far surpasses other major health scares in modern history.

Even so, you may recall 2009 news articles similar to this one from the New York Times (June 11, 2009):

It came as no surprise [on June 11, 2009] when the World Health Organization declares that the swine flu outbreak had become a pandemic.

The disease has reached 74 countries …

And, going further back in time, the World Health Organization provided this July 5, 2003 update on the Severe Acute Respiratory Syndrome, known as SARS:

To date, 8439 people have been affected, and 812 have died from SARS.

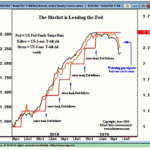

The reason for briefly reviewing the swine flu and SARS is to point out that, as surprising as it may be, both outbreaks marked not the start, but the end of a downtrend in emerging markets stocks.